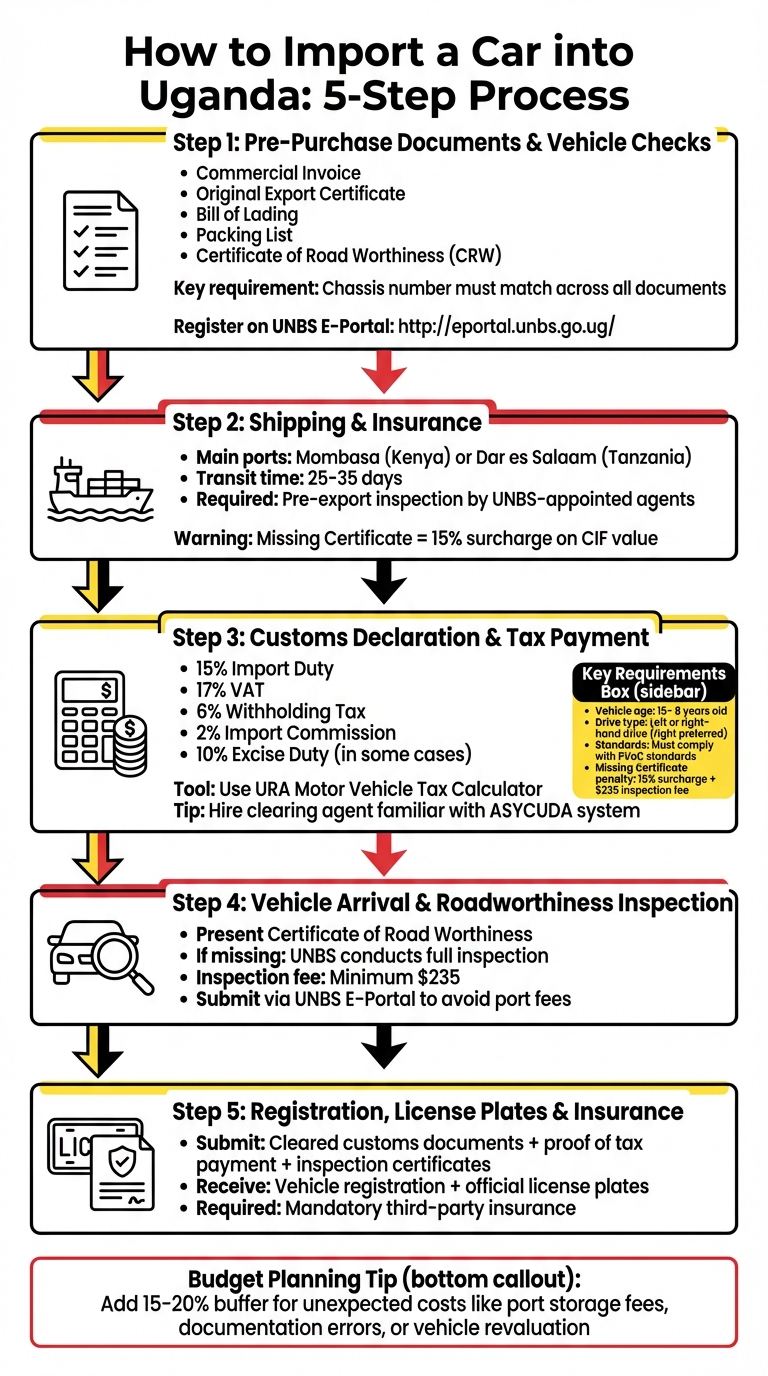

Importing a car into Uganda in 2025 involves several steps, from selecting a vehicle that meets import regulations to completing customs clearance and registration. Here’s what you need to know:

- Key Requirements: Vehicles must be under 8 years old and comply with Uganda’s Pre-Export Verification of Conformity (PVoC) standards. Missing a Certificate of Conformity can result in a 15% surcharge and a $235 inspection fee.

- Taxes: Expect to pay 15% import duty, 17% VAT, 6% withholding tax, and 2% import commission. Other costs include shipping, port handling, and clearing agent fees.

- New Rules for 2025: Mandatory local roadworthiness inspections and Ugandan marine cargo insurance are now required.

- Documentation: Essential documents include the Commercial Invoice, Export Certificate, Bill of Lading, and Certificate of Road Worthiness.

- Shipping: Most vehicles are shipped via Mombasa or Dar es Salaam, with transit times of 25–35 days.

- Registration: After customs clearance and inspection, vehicles must be registered with Ugandan authorities and insured.

To avoid delays and extra costs, ensure all documents are accurate, schedule inspections in advance, and work with experienced clearing agents. Proper preparation is crucial to streamline the process and reduce unexpected expenses.

5-Step Process for Importing a Car into Uganda in 2025

Planning Your Import: Choosing a Vehicle and Setting Your Budget

Selecting a Vehicle That Meets Uganda’s Requirements

When importing a vehicle into Uganda, it’s important to understand the country’s specific requirements. Uganda allows both left-hand drive and right-hand drive vehicles, but right-hand drive is the norm for its roads. A key restriction to keep in mind is that most vehicles should not exceed 8 years of age for import eligibility. Additionally, your vehicle must comply with the Pre-Export Verification of Conformity (PVoC) standards. Without a valid Certificate of Conformity, you’ll face a 15% surcharge and a minimum inspection fee of $235.

The Uganda Revenue Authority (URA) classifies vehicles into categories like Ambulances, Engineering Plant, Estate/Station Wagons, Goods Vehicles, Passenger Vehicles, Sedans, and Tractor Heads, and these classifications can influence the taxes you’ll need to pay. To avoid clearance delays, ensure the chassis number matches across all critical documents, including the Bill of Lading, Export Certificate, and Commercial Invoice.

Once you’ve chosen a vehicle that meets these requirements, it’s time to estimate the full cost of your import.

Calculating Your Total Import Cost

The cost of importing a vehicle goes far beyond its purchase price. To get an accurate estimate, use the URA’s online Motor Vehicle Calculator, which factors in details like the type of vehicle, manufacturing year, and condition. Uganda’s standard tax structure typically includes:

- 15% Import Duty

- 17% VAT

- 6% Withholding Tax

- 2% Import Commission

- 10% Excise Duty (applicable in some cases)

These taxes are calculated based on the "dutiable value", which customs officials determine using G.A.T.T. valuation methods.

On top of taxes, you’ll need to account for shipping costs. Vehicles are usually shipped from the ports of Mombasa (Kenya) or Dar-es-Salaam (Tanzania), with transit times ranging from 25 to 35 days. Other costs to include in your budget are port handling fees, marine cargo insurance, clearing agent fees, and land transportation from the port to Uganda’s border. To streamline this process, work with a clearing agent familiar with URA and UNBS procedures.

After calculating these expenses, it’s wise to set aside extra funds for unplanned situations.

Adding a Buffer for Unexpected Costs

Unexpected costs can arise during the import process, so it’s a good idea to add a 15–20% buffer to your budget. For instance, delays in clearing your vehicle can lead to daily port storage and demurrage fees, which can quickly add up. Errors in documentation, such as mismatched chassis numbers or name discrepancies, may result in penalties or correction fees. Additionally, if the URA revalues your vehicle above its purchase price, you could face higher tax obligations.

For returning residents, missing the six-month import deadline can mean losing tax exemptions, further increasing costs. To minimize these risks, ensure all your documents are accurate and share them with your clearing agent well before your vehicle arrives. Proper preparation can save you time, money, and unnecessary stress.

Finally a NEW CAR! | Step by Step: Importing a Car from Japan to Uganda

Step-by-Step Import Process

Here’s a clear guide to help you navigate Uganda’s car import process for 2025.

Step 1: Pre-Purchase Documents and Vehicle Checks

Before you finalize your vehicle purchase, gather these key documents:

- Commercial Invoice: Lists the purchase price and is used by the Uganda Revenue Authority (URA) to calculate taxes.

- Original Export Certificate: Confirms the vehicle has been deregistered in its country of origin.

- Bill of Lading: Serves as proof of shipment ownership.

- Packing List: Describes the vehicle and any included accessories.

- Certificate of Road Worthiness (CRW): Obtained through the Pre-Export Verification of Conformity (PVoC) inspection.

Make sure the chassis number matches across the Bill of Lading, Export Certificate, and Commercial Invoice. Any mismatch can lead to customs delays and additional costs. For vehicles valued above $2,000 FOB, participation in the PVoC program is required. You’ll also need to register on the UNBS E-Portal (http://eportal.unbs.go.ug/) for inspection requests and clearance applications.

"Missing documents can cause serious delays and extra costs. Therefore, understanding the required paperwork is essential." – Everycar.jp

With everything in order, you can proceed to arrange shipping and secure insurance.

Step 2: Shipping and Insurance

Most vehicles destined for Uganda are shipped via Mombasa, Kenya, or Dar es Salaam, Tanzania. Your shipping provider will issue the Bill of Lading, which is necessary for releasing the vehicle at the port. Ensure the vehicle undergoes a pre-export inspection by UNBS-appointed agents. Without a valid Certificate of Road Worthiness, you could face a 15% surcharge on the CIF value at the Ugandan border. Additionally, you’ll need an Insurance Certificate to complete your URA documentation package.

Step 3: Customs Declaration and Tax Payment

Once shipping is arranged, begin the customs declaration process. Use the Uganda Revenue Authority system to declare your vehicle before it arrives. To estimate your duties, take advantage of the URA Motor Vehicle Tax Calculator, which factors in details like the vehicle type, manufacturing year, and engine capacity. Keep in mind that vehicles must meet Uganda’s safety and environmental standards. Non-compliant vehicles may be seized, destroyed, or re-exported at your expense. To streamline the process, consider hiring a clearing agent familiar with the ASYCUDA system.

Step 4: Vehicle Arrival and Roadworthiness Inspection

After your vehicle arrives, the focus shifts to clearance and inspection. Present your Certificate of Road Worthiness to expedite the process. Vehicles that passed the pre-export inspection typically clear this stage with minimal issues. However, if the certification is missing, the Uganda National Bureau of Standards (UNBS) will conduct a full roadworthiness inspection locally.

"Vehicles without inspection approval may be rejected. Therefore, inspection is not optional." – Everycar.jp

Submit clearance applications promptly via the UNBS E-Portal to avoid accumulating port fees.

Step 5: Registration, License Plates, and Insurance

Once your vehicle clears customs and passes inspection, it’s time to register it with Ugandan authorities. Submit your cleared customs documents, proof of tax payment, and inspection certificates to complete the registration process. Afterward, you’ll receive your vehicle registration and official license plates. Don’t forget to obtain mandatory third-party insurance, as required by local traffic laws.

sbb-itb-7bab64a

Import Rules for Different Vehicle Types

Understanding the specific requirements for different types of vehicles is essential to ensure compliance with import regulations. Here’s a breakdown of the rules based on fuel type.

Used Gas and Diesel Vehicles

For used gas and diesel vehicles, the manufacturing date must fall within the last 15 years. However, if the vehicle is more than 8 years old, an additional environmental levy applies. Both left-hand drive and right-hand drive models are allowed.

These vehicles must pass environmental compliance checks as part of the Pre-Export Verification of Conformity inspection. Inspectors assess emissions and engine functionality to ensure they meet standards. The Uganda National Bureau of Standards (UNBS) strictly enforces these requirements to block substandard vehicles from entering the market.

Taxes for these vehicles include Import Duty, which ranges between 15% and 25% of the dutiable value, a 17% VAT, a 2% Import Commission, and a 6% Withholding Tax. In some cases, an Excise Duty of 10% to 20% may also apply. If the vehicle is imported from Japan, adhering to specific inspection protocols is mandatory.

Electric and Hybrid Vehicles

Electric and hybrid vehicles must also adhere to the 15-year age limit and undergo a mandatory Road Worthiness Inspection before shipping. These vehicles are taxed at the same rates as gas-powered models.

When importing electric vehicles, it’s essential to include a detailed list of all electrical components with their serial numbers in the documentation. For imports from Japan, a radioactive contamination inspection certificate is required prior to shipment. Additionally, a Certificate of Conformity is non-negotiable; without it, registration in Uganda is not possible. Inspection fees through UNBS or QISJ are approximately $300 at their facility or $325 if done at a location of your choosing.

With these vehicle-specific rules in mind, the next section will cover common mistakes to avoid during the import process.

Common Mistakes and How to Avoid Them

Mistakes to Avoid

Errors in documentation can lead to delays and unnecessary expenses. For instance, mismatched chassis numbers or names across key documents can result in penalties and hold-ups. Double-checking these details is crucial to avoid such issues.

Another common oversight is underestimating tax obligations. Failing to account for charges like the 17% VAT and 6% Withholding Tax can lead to unexpected costs. Similarly, skipping the PVoC inspection before shipping is a costly mistake. Vehicles arriving without a PVoC Certificate are subject to a mandatory UNBS inspection, which starts at $235 and can include penalties of up to 15% of the CIF value.

Importers should also avoid using abbreviations on packing lists and ensure they submit only original documents. For instance, the URA mandates the submission of the original Export Certificate – photocopies are not accepted. Additionally, under-declaring the vehicle’s value on the Commercial Invoice is risky. Customs officers rely on G.A.T.T valuation methods to verify declared prices, which can lead to disputes and delays if discrepancies arise.

By understanding these common pitfalls, you can take proactive steps to streamline the import process.

Tips for a Smooth Import Process

- Double-check your documentation: Ensure all chassis numbers match exactly across every document.

- Schedule necessary inspections: Arrange for JEVIC or PVoC inspections in the vehicle’s country of origin through an authorized agency. Skipping this step is not worth the risk.

- Prepare original documents: Have your original Export Certificate sent via courier, ensure your Commercial Invoice reflects the actual transaction price, and avoid abbreviations on packing lists – use clear, full descriptions in English.

- Use the UNBS E-Portal: Register at UNBS E-Portal to submit inspection requests online and save time.

- Work with experienced clearing agents: Partnering with knowledgeable agents familiar with URA and UNBS procedures can help reduce errors and complications.

- Check for prohibited items: Before purchasing, verify that the vehicle doesn’t include items from the "Negative List", like used tires or specific batteries, which may require separate import certificates from the Ministry of Trade.

- Estimate taxes accurately: Use the official URA Motor Vehicle Tax Calculator to get precise tax estimates based on your vehicle type and manufacturing year.

Conclusion: What You Need to Know About Importing a Car to Uganda in 2025

Bringing a car into Uganda in 2025 calls for careful planning and attention to detail. The process involves several government bodies, with the Uganda Revenue Authority (URA) handling customs and taxes, while the Uganda National Bureau of Standards (UNBS) ensures vehicles meet safety and roadworthiness standards. This dual oversight means you need to stay organized from the very beginning.

Getting your paperwork right is non-negotiable. A pre-export inspection is mandatory, and skipping it could result in penalties. Without this certificate, your vehicle will require a UNBS inspection upon arrival, along with a minimum penalty of $235. Double-check all documents to avoid clearance delays and costly storage fees at the port.

With updated inspection and tax protocols for 2025, budgeting becomes even more crucial. Import costs generally include a 15% import duty, 17% VAT, 6% withholding tax, and a 2% import commission. Shipping typically takes 25–35 days from major ports, so plan for these timelines and set aside funds for any unexpected expenses.

Beyond financial planning, working with experienced professionals can make a big difference. Partner with skilled clearing agents who are familiar with URA and UNBS procedures. They can guide you through G.A.T.T valuation methods and ensure you submit original documents, as photocopies won’t be accepted. If you’re a returning resident who has lived abroad for at least two years, you might even qualify for duty-free import of one vehicle, as long as it was registered in your name in the country of origin.

Success in this process depends on preparation and compliance. Make sure your Tax Identification Number (TIN) is ready, schedule inspections before shipping, and always declare your vehicle’s correct value on the Commercial Invoice. These steps will help protect your investment and ensure a smooth journey for your imported car to Ugandan roads.

FAQs

What are the updated car import rules for Uganda in 2025?

Starting in 2025, Uganda is rolling out updated rules for vehicle imports. Here’s what you need to know:

- Only used cars less than 15 years old will be allowed.

- Vehicles must meet EURO 4 emission standards.

- A valid Certificate of Road Worthiness or Certificate of Conformity is mandatory.

- For any bill of lading issued after April 14, 2025, a Pre-Export Verification of Conformity (PVOC) is required.

- Vehicles must undergo a UNBS/JEVIC road-worthiness inspection.

- Starting February 2025, securing local insurance will also be compulsory.

Double-check these requirements to ensure your vehicle meets all the regulations and avoid unnecessary delays during the import process.

What steps can I take to avoid extra costs when importing a car into Uganda?

When importing a car into Uganda, you can avoid extra expenses by ensuring the vehicle is less than 15 years old. Older cars often come with higher taxes or may even face restrictions. To keep the process smooth, gather all necessary documents in advance. These include the JEVIC certificate, logbook, bill of lading, invoice, and a valid ID.

Partnering with a trustworthy, registered clearing agent can make customs clearance much easier and help you sidestep unexpected costs. Select a port that’s most convenient for you, like Mombasa or Dar es Salaam, to keep transportation costs in check. Don’t forget to arrange for mandatory insurance early on. Using the URA tax calculator to estimate duties and fees is also a smart move – it’ll help you plan your budget and avoid any unwelcome surprises.

What documents do I need to import a car into Uganda?

To bring a car into Uganda, you’ll need to gather a few essential documents. These include:

- JEVIC road-worthiness certificate: Confirms the car meets required safety and quality standards.

- Original vehicle logbook: Serves as proof of ownership.

- Bill of lading: Provides shipment details and acts as a receipt.

- Commercial invoice: Lists the car’s value and purchase specifics.

- Personal identification: A passport or national ID, along with your taxpayer ID number (TIN).

Having these documents in order will help streamline the import process and minimize potential delays.

Related Blog Posts

- How to Import a Car to Uganda: Complete Guide 2025

- How to register a used car in Uganda

- Importing a car to Uganda: taxes explained

- Car import duties in Uganda: URA fees, taxes and clearance process