Importing a car into Uganda can save you money and offer access to a broader range of vehicles. However, the process involves strict regulations, taxes, and required documentation. Here’s what you need to know:

- Vehicle Age Limit: Cars must be under 15 years old from their first registration date.

- Mandatory Inspection: Pre-shipment inspection by JEVIC or a UNBS-approved agent is required.

- Right-Hand Drive Rule: Only right-hand drive (RHD) vehicles are allowed.

- Taxes and Duties: Expect import duty (25%), VAT (18%), withholding tax (6%), and other fees based on the vehicle’s CIF value.

- Emissions Standards: Vehicles must meet Euro 4 standards.

- Required Documents: Includes the Bill of Lading, commercial invoice, export certificate, and more.

- Shipping Routes: Common routes are via Mombasa (Kenya) or Dar es Salaam (Tanzania).

- Digital Clearance: Use URA’s online system for tax payments and customs clearance.

Preparation is key to avoiding delays, penalties, or extra costs. Double-check all requirements and consider hiring a licensed clearing agent for a smoother process.

Finally a NEW CAR! | Step by Step: Importing a Car from Japan to Uganda

1. Uganda’s 15-Year Vehicle Age Limit

In Uganda, vehicles older than 15 years from their first registration date are not allowed for import. This rule, enforced by the Uganda National Bureau of Standards (UNBS), aims to maintain road safety and align with environmental standards. Keep in mind that the 15-year limit is based on the vehicle’s first registration date in its country of origin, not its manufacturing year.

Before buying a vehicle for import, it’s crucial to check the original logbook or export documents to confirm the first registration date. For example, a 2012 model registered in early 2012 would become ineligible for import by January 2026. If the vehicle turns 15 before it arrives in Uganda, it will not meet the import criteria.

Vehicles that exceed the 15-year limit will fail the mandatory roadworthiness inspection. The Ministry of Works & Transport will not register such vehicles, leaving them stuck at the port or in bonded warehouses, where storage fees will pile up.

To avoid these complications, collaborate with a reliable clearing and forwarding agent and thoroughly verify all documentation before shipping. Additionally, ensure the vehicle undergoes a UNBS-authorized pre-shipment inspection, such as JEVIC, to secure a Certificate of Conformity. This certificate confirms the vehicle’s age and compliance with import standards.

Important note: Heavy-duty commercial vehicles, like buses carrying more than 13 passengers or trucks with a capacity exceeding two tonnes, may have additional restrictions under duty-free schemes. Always double-check that your vehicle category meets all necessary conditions before finalizing your purchase.

Once you’ve confirmed the vehicle’s age, move on to verifying its compliance with pre-shipment inspection requirements in the next section.

2. Mandatory JEVIC Pre-Shipment Inspection

If you’re importing a used vehicle into Uganda, there’s one critical step you can’t skip: Road Worthiness Inspection (RWI). This inspection must be completed before the vehicle leaves its country of origin. To ensure compliance, the Uganda National Bureau of Standards (UNBS) has authorized the Japan Export Vehicle Inspection Center (JEVIC) to handle these checks. Without a valid JEVIC certificate, your vehicle could face major delays or even rejection at customs.

The inspection process evaluates five key areas:

- Safety components like brakes and tire tread depth

- Structural integrity, including checks for rust on the chassis

- Mechanical functionality, such as engine performance and CV joints

- Emission standards to limit environmental impact

- Mileage verification to confirm odometer accuracy

This thorough review ensures that unsafe or unreliable vehicles don’t make it onto Uganda’s roads, protecting both people and the environment.

Scheduling the JEVIC inspection must be done in the country where the vehicle is purchased. If your vehicle arrives in Uganda without the certificate, it will undergo a destination inspection and incur a hefty penalty – 15% of the vehicle’s CIF (Cost, Insurance, and Freight) value. Since inspection fees vary depending on location, it’s wise to confirm the rates in your region ahead of time. Once you have the certificate, you’re all set to continue with your import process.

"If the product does not meet the critical minimum requirements for health, safety and performance as set out in the relevant Uganda Standards, such product is prohibited entry on those grounds and seized for destruction or re-exportation at the importer’s expense." – Uganda National Bureau of Standards

Before the inspection, make sure your vehicle is ready. Check that all lights are functioning, tires are in good condition, and the body and chassis are free of rust. You can oversee the process yourself or hire an agent to manage the JEVIC documentation and clearance. Once you’ve secured your Certificate of Road Worthiness, you can confidently move forward with shipping arrangements.

3. Right-Hand Drive Requirement

In Uganda, there’s a strict rule when it comes to importing vehicles: only right-hand drive (RHD) vehicles are permitted. This rule is in place to ensure safety, as Uganda drives on the left-hand side of the road. Left-hand drive vehicles do not meet the required safety standards and will not pass customs clearance.

"Uganda only allows right-hand drive (RHD) vehicles, as the country drives on the left-hand side of the road. Always confirm the car is RHD before purchase." – Charge Ninja

This regulation significantly influences where you can source vehicles. Japan leads as the top supplier for Uganda’s used car market, offering a wide range of affordable RHD vehicles. Other reliable sources include the UK, Australia, Singapore, and specific RHD export lines from China. Manufacturers like BYD, Neta, and Dongfeng provide RHD models tailored for Uganda’s market.

To ensure compliance, it’s crucial to verify the vehicle’s VIN or model details to confirm it was factory-manufactured as an RHD model. Keep in mind that, under the current 2025 regulations, converting a left-hand drive vehicle to RHD is not only expensive and complicated but also fails to meet Uganda Standard KS 1515:2000.

4. Import Taxes and Duties Breakdown

Understanding the tax structure is crucial when calculating import costs. In Uganda, the Uganda Revenue Authority (URA) bases taxes on the CIF (Cost, Insurance, and Freight) value of your vehicle – not the price you paid for it. This valuation relies on the URA’s standardized Motor Vehicle Value Guide, which is updated monthly to reflect market trends.

"Contrary to common belief, the purchase price of a used vehicle does not directly influence its tax value. Instead, the URA provides a motor vehicle value guide on its portal, which outlines customs values for used cars, updated on a monthly basis." – Ibrahim Bbosa, Spokesperson, Uganda Revenue Authority

Here’s a breakdown of the taxes you’ll encounter:

- Import Duty: 25% of CIF value

- VAT: 18% applied to the sum of CIF and Import Duty

- Withholding Tax: 6% of CIF value

- Infrastructure Levy: 1.5% of CIF value

Additionally, an environmental levy may apply to older vehicles. However, vehicles manufactured in 2023 or later and less than five years old are exempt from this charge.

To get an accurate estimate, use the URA Motor Vehicle Import Duty Calculator available on their official website before shipping your car. For example, in early 2026, a 2017 Subaru Forester SJ5 (2,000 cc) was taxed approximately UGX 15.88 million, while a 2010 BMW X1 (2,000 cc) incurred taxes of around UGX 18.27 million. These cases highlight how factors like vehicle age, engine size, and body type influence the final tax amount.

Before calculating taxes, ensure you have your URA TIN, original logbook, and commercial invoice ready. The URA’s digital tools incorporate updated exchange rates and official valuations to provide accurate results.

Next, let’s explore how taxes differ based on vehicle types.

5. Euro 4 Emissions Standards

Uganda mandates that all imported vehicles comply with Euro 4 emissions standards. These requirements are outlined under Standard US845, which details the safety and performance specifications for imported used vehicles. The Uganda Bureau of Standards (UNBS) enforces these regulations through its Pre-Export Verification of Conformity (PVoC) program.

"Products falling under compulsory standards are deemed to have a bearing on the health and safety of the consumer as well as the environment and as such they shouldn’t fall short of what is stipulated in the standard." – Uganda Bureau of Standards (UNBS)

Knowing these standards can help narrow down your vehicle options. Typically, vehicles manufactured after 2005–2006 are more likely to meet Euro 4 standards, as this was when the regulation became widespread. When exploring cars in markets like Japan or Europe, always check the year of manufacture listed in the original logbook or export certificate. Since used cars make up 80% of vehicles on Ugandan roads, confirming compliance is a critical step.

To ensure a vehicle meets emissions standards before purchasing, request a Certificate of Road Worthiness (CRW) from the exporter. For cars imported from Japan, JEVIC handles both roadworthiness and emissions compliance verification. You can also use the UNBS e-Portal (eportal.unbs.go.ug) to submit inspection requests and monitor compliance status.

Skipping proper certification can lead to costly penalties. If a vehicle arrives at the border without a valid Certificate of Conformity or CRW, a 15% surcharge on the vehicle’s CIF (Cost, Insurance, and Freight) value will be applied in addition to standard import taxes. To avoid unexpected expenses or delays, confirm compliance with authorized inspection agents before making a purchase.

sbb-itb-7bab64a

6. Required Documentation for Clearance

To get your vehicle through Ugandan customs, you’ll need to have these seven documents ready:

- The original Bill of Lading (plus two negotiable copies)

- A Commercial Invoice that includes the purchase price, as well as details about the buyer and seller

- The Original Export Certificate (logbook)

- A Pre-Export Inspection Certificate from an authorized inspector

- Your URA Tax Identification Number (TIN)

- A Packing List describing the vehicle

- Your passport (and work permit, if applicable).

Accuracy is key here – any mismatched details, like chassis numbers or names, can cause delays. For instance, if you don’t have a valid Pre-Export Certificate of Conformity, your vehicle will need an inspection by the Uganda National Bureau of Standards (UNBS), which costs at least $235.

Once your paperwork is in order, the actual clearance process happens online. The Uganda Revenue Authority (URA) handles everything digitally. Typically, clearing agents handle this part for you, but in some cases, you’ll get a direct link to pay taxes yourself. To avoid extra storage fees at ports like Mombasa or Dar es Salaam, make sure to register on the UNBS E-Portal (http://eportal.unbs.go.ug/) ahead of time. This allows you to submit inspection requests and upload documents before your vehicle arrives.

Hiring a licensed clearing agent who knows their way around the URA and UNBS systems can save you a ton of hassle. These agents not only handle the online process but also cover port charges and transportation to Kampala. Their fees usually range between $2,500 and $3,500.

7. Shipping Routes via Mombasa or Dar es Salaam

Uganda, being landlocked, relies on two main ports for vehicle imports: Mombasa in Kenya and Dar es Salaam in Tanzania. About 75% of vehicles come through Mombasa, typically entering Uganda at either Malaba or Busia.

When it comes to costs, there’s little difference between the two routes. The deciding factor often comes down to the administrative processes involved. For instance, shipping through Dar es Salaam requires registration with the Tanzania Revenue Authority (TRA) and obtaining a TIN (Tax Identification Number). On the other hand, importing via Mombasa comes with an Import Declaration Fee (IDF), which is 2.25% of the vehicle’s CIF value, with a minimum charge of Ksh. 5,000. These requirements can also impact how smoothly the transit process unfolds.

Transit times are fairly similar for both routes. If you’re shipping from the UK to Mombasa, the ocean journey takes about 25 days, and full delivery to Kampala typically spans 56 to 62 days. For shipments from U.S. ports to East Africa, ocean transit ranges from 30 to 45 days.

Once inland, you have two main options for transporting your vehicle to Uganda. You can use a dedicated car transporter or leave the vehicle in its shipping container for added security – this is often the preferred choice for high-value or luxury cars.

8. Using URA’s Digital Clearance System

The Uganda Revenue Authority (URA) offers an online clearance system that simplifies the vehicle import process. However, before diving in, you’ll need to appoint a licensed Clearing Agent and obtain a Tax Identification Number (TIN). The system integrates detailed documentation and tax verification to make the clearance process smoother.

Entering your vehicle details into the system not only registers your ownership but also speeds up processes like number plate allocation, registration, and even future ownership transfers. Additionally, digital registration is required if you plan to use your vehicle as collateral.

Before starting, gather these essential documents:

- Bill of Lading

- Original supplier invoice

- Certificate of Origin

- Insurance certificate

- Transit documents (such as C63 and T1)

For companies, a Certificate of Incorporation is also required. If any documents are in a language other than English, ensure they are translated. Once your paperwork is ready, URA’s digital system simplifies tax calculations and clearance procedures even further.

To estimate your tax liability, take advantage of the URA Motor Vehicle Tax Calculator available on their website (ura.go.ug). By entering details like your vehicle type (e.g., Sedan, Estate, or Goods Vehicle), the year of manufacture (supported years range from 1992 to 2025), and its condition (New or Old), you can quickly get a detailed tax breakdown.

If you prefer in-person help, you can visit URA Service Centers located across Uganda. These include the Central Service Office at Crested Towers in Kampala, as well as regional branches in Jinja, Mbale, Gulu, and Mbarara.

The digital system also supports initiatives like the Authorized Economic Operator (AEO) program, which allows compliant importers to clear customs faster using Non-Intrusive Inspection (NII) at border points. By blending digital tools with earlier import procedures, the URA ensures a smoother and more efficient clearance process for vehicle importers.

Import Taxes and Duties by Vehicle Type

Uganda Car Import Taxes and Duties Breakdown by Vehicle Type

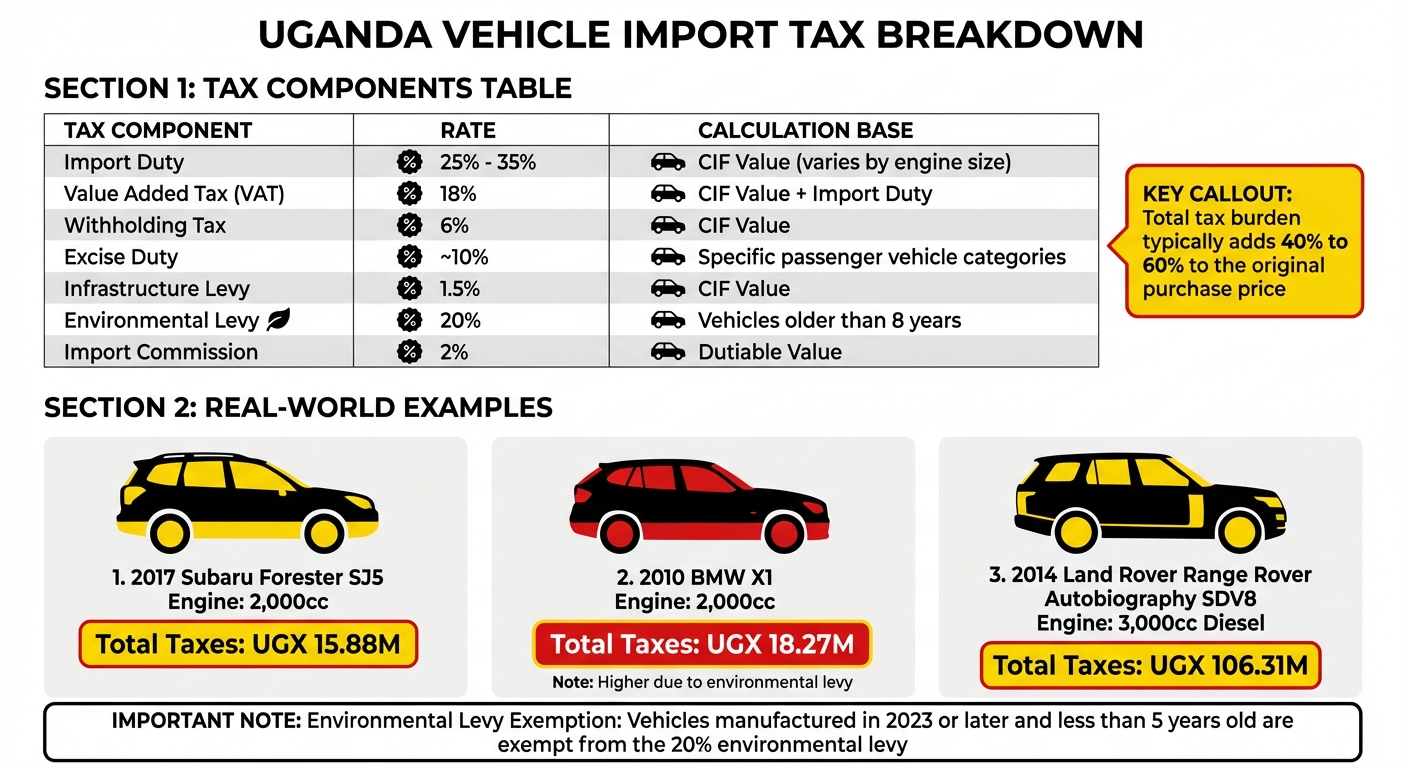

When importing a vehicle into Uganda, understanding the tax structure is crucial for accurate budgeting and avoiding unexpected costs at customs. The country’s tax system applies several layers of charges based on a vehicle’s CIF (Cost, Insurance, and Freight) value. By the time your car clears customs, the total tax burden typically adds 40% to 60% to the original purchase price.

For vehicles older than eight years, there’s an additional 20% environmental levy, unless the vehicle was manufactured in 2023 or later and is less than five years old. Here’s a breakdown of the various taxes and how they are calculated for different vehicle types:

| Tax Component | Rate | Calculation Base |

|---|---|---|

| Import Duty | 25% – 35% | CIF Value (varies by engine size) |

| Value Added Tax (VAT) | 18% | CIF Value + Import Duty |

| Withholding Tax | 6% | CIF Value |

| Excise Duty | ~10% | Specific passenger vehicle categories |

| Infrastructure Levy | 1.5% | CIF Value |

| Environmental Levy | 20% | Vehicles older than 8 years |

| Import Commission | 2% | Dutiable Value |

These layered charges mean that the total tax impact can vary significantly depending on the vehicle’s age, type, and engine size. For example:

- A 2017 Subaru Forester SJ5 (2,000cc) imported in 2020 incurred UGX 15.88M in taxes.

- A 2010 BMW X1 (2,000cc) faced a higher tax of UGX 18.27M, largely due to the environmental levy.

- Larger, older vehicles bear even steeper costs. For instance, a 2014 Land Rover Range Rover Autobiography SDV8 (3,000cc Diesel) attracted a whopping UGX 106.31M in total taxes.

The consistency in tax rates over the years has made importers cautious. As George Ateka, a car dealer based in Kampala, explains:

"When taxes stay the same for too long, government eventually adjusts."

Susan Musiime, another dealer, adds:

"Government needs money, and vehicles are easy to tax."

This concern often prompts buyers to import vehicles before new budget cycles, especially as age-related environmental levies aim to discourage older, high-emission cars.

Conclusion

Bringing a car into Uganda involves navigating a maze of regulations and costs. To get through customs smoothly, you’ll need to meet all requirements, including mandatory inspections and obtaining UNBS certifications for clearance. This guide lays out the essentials to help you finalize your import plans.

Be prepared for import costs to add significantly to your car’s total price. Taxes like duty, VAT, and other fees can pile up quickly, often making the final expense much higher than the CIF value. It’s important to budget for these additional charges.

Having the right paperwork is non-negotiable for customs clearance. The Uganda Revenue Authority (URA) requires key documents, including the Original Bill of Lading, Commercial Invoice, Original Export Certificate, and a Tax Identification Number (TIN). Double-check that chassis numbers and consignee names are consistent across all documents. Even minor mismatches can lead to delays and extra port fees. Once your paperwork is in order, the digital clearance process becomes much easier.

The UNBS E-Portal (http://eportal.unbs.go.ug/) has simplified the inspection process, but for first-time importers, navigating the digital system can be tricky. This is where professional clearing agents come in. These experts are familiar with the process and can help you avoid errors like missing documents or dealing with items on the "negative list", which require special import certificates valid for six months.

Ultimately, solid preparation is your best defense against costly delays. Get your documentation ready well before your vehicle arrives, follow all compliance rules, and consider hiring a licensed clearing agent to handle the more technical aspects. A good clearing agent can save you time, minimize penalties, and make the entire process far less stressful.

FAQs

What happens if I import a car into Uganda without completing the required inspections?

Importing a car into Uganda without completing the required inspections can lead to serious challenges. Although exact penalties might not always be explicitly stated, you could face scenarios like your vehicle being denied entry, incurring fines, or needing inspections at your own cost before it can be registered or driven.

To save yourself from delays, unexpected expenses, and possible legal troubles, make sure your car complies with all inspection requirements before shipping it to Uganda.

How can I confirm if a car meets Euro 4 emissions standards before importing it to Uganda?

To ensure a car meets Euro 4 emissions standards before shipping it to Uganda, here’s what you need to do:

- Obtain the Certificate of Conformity (CoC): This document, available from the manufacturer or exporter, confirms the vehicle adheres to Euro 4 emissions standards, including limits on pollutants like NOx and particulate matter.

- Conduct a Pre-Export Verification of Conformity (PVoC): In the exporting country, an accredited agent will verify the CoC, carry out emissions testing, and issue a certificate needed for customs clearance in Uganda.

- Undergo the Uganda National Bureau of Standards (UNBS) inspection: Once the car arrives in Uganda, it must pass this inspection to confirm compliance with emissions standards and roadworthiness for local registration.

With the CoC, PVoC, and a successful UNBS inspection, you’ll have assurance that the car meets Uganda’s regulations.

What should I do if the car I want to import into Uganda is more than 15 years old?

If you’re planning to import a car into Uganda, keep in mind that vehicles over 15 years old from their manufacturing date are not allowed. This regulation, effective since October 1, 2018, is strictly upheld by the Uganda Revenue Authority (URA) and the Uganda National Bureau of Standards (UNBS).

If you’ve already shipped a vehicle that doesn’t meet this requirement, you have two primary options:

- Re-export the vehicle: You can send it back to its origin or to another country where it complies with import rules. It won’t clear Ugandan customs otherwise.

- Avoid attempting clearance: Any vehicle left unclaimed in bonded warehouses risks being seized and auctioned by customs authorities.

In summary, importing a car older than 15 years into Uganda is not permitted. Your best bet is to arrange for its return or redirect it to a country with compatible import regulations.

Related Blog Posts

- How to Import a Car to Uganda: Complete Guide 2025

- How to register a used car in Uganda

- Importing a car to Uganda: taxes explained

- Car import duties in Uganda: URA fees, taxes and clearance process