Car financing in Uganda helps you buy a vehicle without paying the full price upfront. You can choose from bank loans, microfinance options, or dealership programs. Each has different terms, down payment requirements, and eligibility criteria. For instance, banks like Absa and NCBA finance up to 100% for new cars, but you’ll need a steady income and good credit. Microfinance institutions are more flexible but often require guarantors and extra documents. Dealerships streamline the process by combining car selection and financing.

Key Points:

- Options: Bank loans, microfinance institutions, dealership financing.

- Eligibility: Stable income (min UGX 1,000,000/month), good credit, and vehicles under 10 years old.

- Costs: Down payments (20%-30%), arrangement fees (~2%), and mandatory insurance (4%-5% of car value annually).

- Repayment Terms: Up to 8 years for bank loans; shorter for microfinance options.

If you’re planning to finance a car, start by reviewing your income, credit score, and lender requirements to find the best fit for your needs.

Finally! Affordable Cars and Good Payment Methods in Uganda

sbb-itb-7bab64a

Car Financing Options in Uganda

Car Financing Options in Uganda: Banks vs Microfinance vs Dealerships Comparison

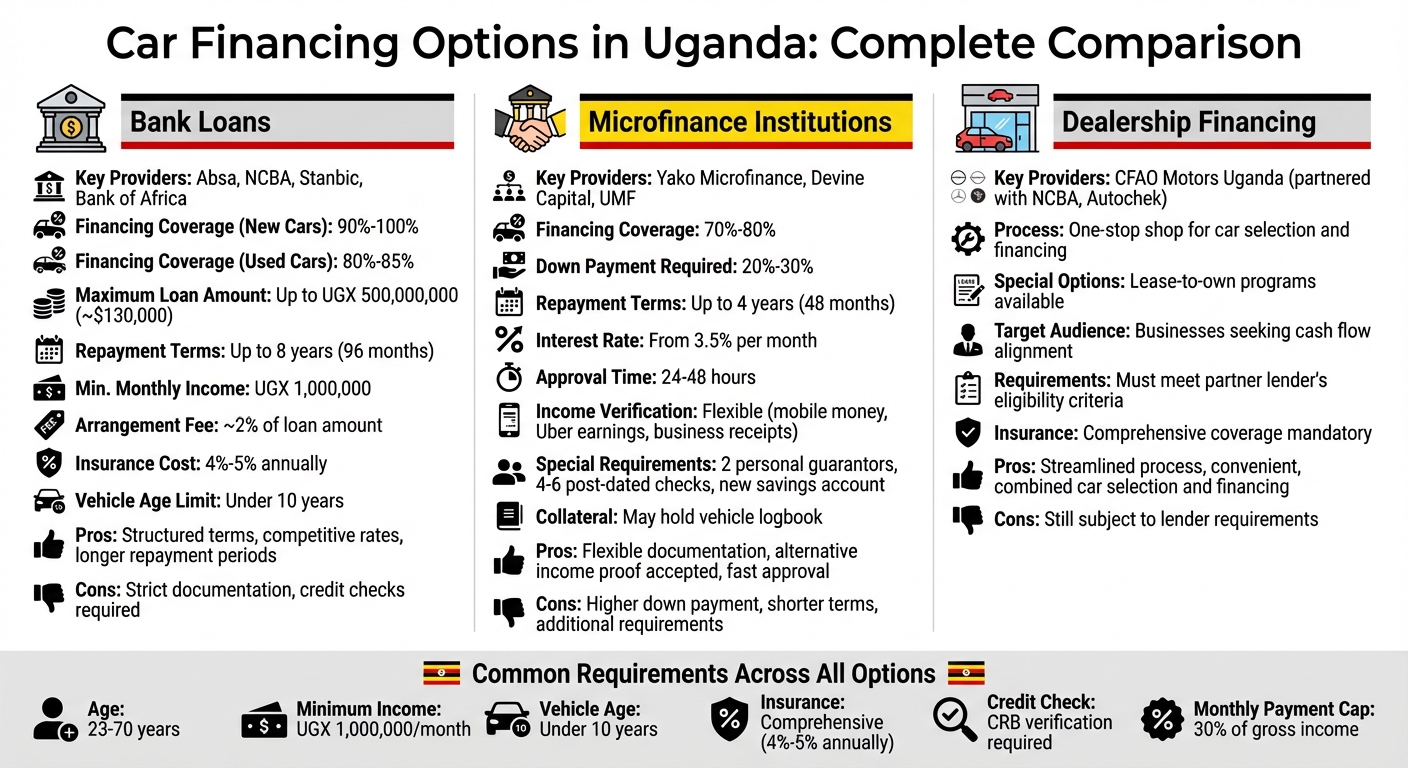

When it comes to financing a car in Uganda, you have three main options: bank loans, microfinance institution loans, and dealership financing programs. Each has its own set of conditions and perks, making it important to weigh your choices carefully. Here’s a closer look at what each option offers.

Bank Loans

Commercial banks like Absa, NCBA, Stanbic, and Bank of Africa are key players in Uganda’s car financing market. Absa, for example, offers financing for up to 100% of the cost for brand-new vehicles and 85% for used cars, with repayment terms stretching up to 8 years. NCBA finances up to 90% for new cars and 80% for used ones, while Bank of Africa provides repayment plans lasting up to 6 years.

Most banks finance vehicles valued at up to UGX 500,000,000 (around $130,000) and require borrowers to have a minimum monthly income of UGX 1,000,000. Additionally, vehicles older than 10 years are generally ineligible for financing [3,7]. Expect to pay an arrangement fee of about 2% of the loan amount, and comprehensive insurance typically costs 4% to 5% of the car’s value annually [3,7,8]. Stanbic Bank also caps monthly repayments at 30% of the borrower’s gross monthly income.

If you’re looking for more flexible terms, microfinance institutions might be a better fit.

Microfinance Institutions

Microfinance institutions, like Yako Microfinance, cater to borrowers who may not meet the strict documentation requirements of traditional banks. They often accept alternative proof of income, such as mobile money statements, Uber driver earnings, or business receipts, to gauge repayment ability.

However, this flexibility comes with additional conditions. For example, Yako Microfinance requires two personal guarantors, 4–6 post-dated checks, and a new savings account with their institution. They also conduct their own vehicle valuations, particularly for older cars, and may hold the vehicle’s logbook as collateral until the loan is fully repaid. While they do offer loans exceeding UGX 50,000,000 for corporate clients, the loan terms depend on verified income and the car’s assessed value.

If convenience is a priority, dealership financing programs might appeal to you.

Dealership and Leasing Programs

Dealership financing combines the car-buying and financing process into one streamlined experience. Companies like CFAO Motors Uganda have partnered with financial institutions such as NCBA and Autochek to offer on-site financing. This means you can choose your car and apply for credit all in one place.

Some dealerships also offer lease-to-own options, which are particularly useful for businesses looking to align payments with their cash flow [10,11]. However, even with these programs, you’ll need to meet the lender’s eligibility requirements and secure comprehensive insurance for your vehicle [7,10].

Eligibility Requirements and Required Documents

Before diving into the application process, it’s crucial to ensure you meet the eligibility criteria and have the necessary documents ready. Applicants need to be between 23 and 70 years old and earn a minimum monthly income of UGX 1,000,000 (roughly $260). For USD loans, Absa sets the bar higher, requiring a minimum monthly income of $1,500. To keep repayments manageable, banks like Stanbic limit monthly loan payments to 30% of your gross monthly income.

Income verification is non-negotiable. Whether you’re salaried or self-employed, lenders will require proof of a steady income. For self-employed individuals, institutions such as UMF require that your income source has been active for at least six months. Additionally, vehicles being financed must be less than 10 years old, and comprehensive insurance coverage is a must. These financial conditions align with specific documentation requirements.

Your credit history is another key factor. Lenders check your records through the Credit Reference Bureau (CRB), and a poor credit score or blacklisting can disqualify you. To improve your chances, it’s a good idea to review your credit report for any errors before applying. Be prepared to provide a Financial Card (CRB) and a proforma invoice from a recognized dealership, as these are commonly required by most banks.

Microfinance lenders often ask for additional documents. For example, Yako Bank requires two personal guarantors with verifiable income, 4–6 post-dated checks, and a utility bill to confirm your residence. Some may even request a recommendation letter from your LC1 Chairperson to verify your residency and standing in the community. Foreign nationals must provide a valid passport, work permit, or dependent pass.

Document Requirements by Lender

While documentation varies slightly between lenders, there are many commonalities. Here’s a breakdown of typical requirements from leading institutions:

| Document | Stanbic Bank | NCBA Bank | Bank of Africa | Absa Uganda |

|---|---|---|---|---|

| Identification | Financial Card (CRB) | National ID or Passport | National ID or Passport | Passport (Proof of Nationality) |

| Income Proof | 3 months pay slips & Appointment letter | Payslips & Bank Statements | 3 months salary statements | 3 salary slips & 12 months bank statements |

| Employment Docs | Not specified | Not specified | Contract, Appointment & Confirmation letters | Copy of contract & Work ID |

| Employer Support | Letter of undertaking for salary remittance | Not specified | Letter of Undertaking | Letter of Undertaking |

| Vehicle Docs | Proforma invoice | Proforma Invoice | Proforma Invoice & Valuation Report | Proforma Invoice |

| Tax/Financial ID | Not specified | Not specified | Financial Card | TIN Number & Financial Card |

| Residence Proof | Not specified | Utility bill | Not specified | Not specified |

Self-employed applicants face additional requirements. You’ll need a company profile, three years of audited accounts, a trading license, a cash flow forecast, and 6–12 months of bank statements. Be mindful of upfront costs, too. Most banks charge an arrangement fee of about 2% of the loan amount, along with valuation fees and an initial insurance premium. For instance, Bank of Africa has a flat application fee of UGX 65,000 (approximately $17), while Stanbic charges a one-time bureau fee of UGX 25,000 (around $7).

Financing Percentages, Interest Rates, and Repayment Periods

Once you’ve sorted out the paperwork and eligibility, it’s time to dive into the numbers – financing percentages, interest rates, and repayment periods. These details are critical for planning your purchase and managing your budget effectively.

When it comes to financing, new cars typically qualify for 90%-100% financing, while used cars usually fall in the range of 80%-85%. Microfinance institutions, like Devine Capital, often require a higher down payment – usually 20%-30%.

Interest Rates and How They Work

Commercial banks calculate interest based on the prime rate plus a margin. For instance, NCBA Bank uses a reducing balance method, meaning you pay interest only on the remaining loan principal, not the original amount. On the other hand, microfinance institutions may offer monthly rates starting at 3.5%. Keep a close eye on the current prime rate, as it directly affects your monthly payments.

Repayment Periods

The repayment period varies depending on the lender and the type of vehicle. Most lenders offer terms ranging from 48 to 96 months. For example, NCBA Bank provides a 5-year term for new cars and a 4-year term for used vehicles. However, note that many lenders limit financing to vehicles that are less than 10 years old [3,7].

Additional Costs to Consider

- Arrangement Fees: Most banks charge an arrangement fee of about 2% of the loan amount [3,8].

- Comprehensive Insurance: This is mandatory and typically costs between 4%-5% of the vehicle’s value annually [3,7].

These terms and percentages play a significant role in shaping your overall budget, so it’s essential to understand them fully before committing to a loan. Below is a summary of financing terms offered by key lenders.

Financing Terms by Lender

| Lender | Max Financing (New) | Max Financing (Used) | Max Repayment Period | Key Notes |

|---|---|---|---|---|

| Absa Uganda | 100% | 85% | 8 years (96 months) | 2% arrangement fee; ~4% insurance |

| Bank of Africa | 100% | Not specified | 6 years (72 months) | UGX 65,000 application fee |

| NCBA Bank | 90% | 80% | 5 years (new) / 4 years (used) | Reducing balance interest; ~5% insurance |

| Stanbic Bank | ~80% (20% down payment) | ~80% | 5 years (60 months) | 2% arrangement fee; monthly repayments capped at 30% of income |

| Devine Capital | 70%-80% | 70%-80% | 4 years (48 months) | Interest from 3.5% per month; 24-hour approval |

Understanding these terms will help you make an informed decision and align your financing plan with your financial goals.

How to Apply for Car Financing

Once you’ve confirmed your eligibility and gathered the necessary documents, it’s time to move forward with your car financing application. Start by using online loan calculators from banks like Stanbic or Bank of Africa. These tools can help you estimate your monthly repayments and figure out what fits comfortably within your budget without stretching your finances too thin.

After choosing the vehicle you want, request a proforma invoice from the dealer. If you’re buying a used car, most banks will also ask for a valuation report from an approved valuer. Make sure you have the required documents ready, including your National ID or Passport, TIN, Financial Card, and recent income proof like pay slips or bank statements. If you’re self-employed, you’ll also need to provide a trading license and six months of business statements.

You can then submit your loan application via the lender’s online portal, visit a branch in person, or request assistance from a relationship manager. Some lenders, such as Devine Capital, process approvals within 24 to 48 hours. Once approved, you’ll typically need to pay arrangement fees, which are around 2% of the loan amount or a flat fee ranging from UGX 65,000 to UGX 600,000. Additional costs may include valuation and credit bureau charges.

To boost your chances of approval, ensure your income meets the lender’s requirements. Most banks limit monthly loan repayments to 30% of your gross monthly income, so maintaining a low debt-to-income ratio is key. As Gasta Kevin Opondo, Marketing Lead at Autocheck Uganda, explains:

"Nowadays most lending facilities have access to your credit history, which they use as a guide for determining how risky you are as a borrower".

Making a larger down payment – typically 20%–30% – can also work in your favor by securing better interest rates. Additionally, keep an eye out for special offers from bank-accredited dealerships, which might include discounted rates. Getting pre-approved is another smart move. Opondo highlights the benefits:

"With a pre-approved loan, you will be able to figure out exactly how much you’ll owe and when… this way, you have time to adjust your budget to accommodate the total price".

To finalize the process, arrange for comprehensive insurance, which usually costs 4%–5% of the vehicle’s value annually, and provide the car logbook as security. With these steps completed, you’ll be ready to drive away in your new vehicle.

Other Costs and Considerations

When planning your vehicle purchase, it’s important to account for additional costs like registration fees, obtaining a mandatory TIN, and hiring a professional Clearing Agent. For instance, registering a standard sedan with the Uganda Revenue Authority (URA) costs UGX 1,218,000, while larger estate vehicles with engine capacities of 3,500cc or more will cost UGX 1,718,000. Keep in mind, banks will only accept your vehicle as collateral if it’s fully registered with the URA. Beyond this, factor in ongoing expenses to stay compliant and manage your finances effectively.

Comprehensive insurance, which is legally required, will cost you 4%–5% of your vehicle’s value annually. Under the Motor Vehicles Act of 1998, every vehicle on Ugandan roads must maintain valid insurance at all times. Jacob Muddu, Country Manager at Autochek Uganda, advises prospective buyers to carefully plan their budgets:

"Assess your monthly income and expenses to determine a comfortable monthly installment that won’t strain your finances".

There are also upfront financing fees, such as a 2% arrangement fee, a UGX 25,000 CRB charge, valuation fees, and, for some lenders, a UGX 65,000 application fee. If you opt for a leasing arrangement, an additional ownership transfer fee of 0.5%–1% of the vehicle’s price will apply.

It’s also important to note that banks will only finance vehicles that are less than 10 years old. This policy helps ensure lender approval and reduces long-term maintenance challenges. For used cars, you’ll need to provide the original Registration Book or Cancellation Certificate, and any non-English documents must be translated.

Conclusion

Considering various financing options can help you find a plan that fits your budget and financial objectives. Bank loans often come with structured terms and competitive rates, hire purchase agreements allow ownership transfer after full payment, and leasing provides flexibility for businesses while the financier retains ownership during the lease term.

Loan approval typically hinges on your financial stability and meeting the lender’s requirements. As Jacob Muddu, Country Manager at Autochek Uganda, explains:

"A good credit score can lead to better loan terms, so ensure you maintain a healthy credit record".

Beyond securing the loan, remember to factor in additional expenses like arrangement fees, comprehensive insurance, and registration costs. Since terms can differ greatly among lenders, comparing offers is key. To simplify the process, gather essential documents early – such as your TIN, bank statements, and a proforma invoice from a trusted dealer. This preparation can help you lock in the best terms for your auto financing needs in Uganda.

FAQs

What’s the difference between bank loans and microfinance options for car financing in Uganda?

The key differences between bank loans and microfinance options for car financing in Uganda come down to loan size, eligibility requirements, and repayment terms.

Bank loans generally provide larger amounts – sometimes covering the entire value of the car – and offer extended repayment periods, often up to 72 months. However, they come with stricter requirements, such as extensive documentation, proof of income, and a strong credit history. This makes them a better fit for individuals with stable financial circumstances and a solid credit profile.

In contrast, microfinance options are designed to be more accessible for those who might not meet the qualifications for a traditional bank loan. These loans typically offer smaller amounts, shorter repayment terms, and higher interest rates. They cater to small-scale business owners or individuals with limited credit history who need quick, smaller-scale funding, though they tend to have higher overall borrowing costs.

In short, bank loans are ideal for those seeking larger, long-term financing, while microfinance loans provide a flexible solution for borrowers needing faster access to smaller amounts.

How does my credit score impact my chances of getting car financing in Uganda?

Your credit score plays a major role in determining whether you qualify for car financing in Uganda. A high credit score can open doors to better loan terms, including lower interest rates and larger loan amounts. Some lenders even provide up to 100% financing for new vehicles, but this typically requires a strong credit history. On the flip side, a low credit score might mean higher interest rates, smaller loan amounts, or even outright rejection.

Lenders in Uganda rely on credit reference bureaus to evaluate your financial reliability. A solid credit score signals responsible borrowing and repayment habits, which can improve your chances of approval. Want to increase your eligibility? Prioritize paying off debts on time and managing your credit wisely. A strong credit profile doesn’t just help you secure approval – it can also lead to more favorable loan terms.

What extra costs should I plan for when financing a car in Uganda?

When financing a car in Uganda, it’s crucial to account for extra costs that go beyond just the loan amount. For instance, insurance is often a mandatory expense. This could mean getting comprehensive coverage or a loan protection plan, as many lenders require these for added security.

Other costs to keep in mind include valuation fees, which cover the assessment of the car’s value, and processing fees. These processing fees might include administrative or arrangement charges tied to the loan.

Take time to carefully review your lender’s terms so you’re fully aware of all potential costs and can avoid unexpected surprises along the way.

Related Blog Posts

- How Dealership Financing Works in Uganda

- Ultimate Guide to Car Financing in Uganda

- Car Loans in Uganda: How to Finance Your Vehicle the Smart Way

- Top 10 Most Affordable Cars in Uganda in 2025