Owning a car in Uganda means budgeting for more than just fuel and maintenance – insurance is mandatory. Without at least Third Party Only (TPO) coverage, you risk fines up to UGX 100,000 or even imprisonment. Here’s what you need to know about car insurance costs in 2026:

- Mandatory Third Party Insurance: Covers damage or injury caused to others but doesn’t protect your car. Costs vary by vehicle type, with private cars starting around $160 annually for COMESA coverage (cross-border travel).

- Optional Coverage: Third-Party Fire and Theft (TPFT) adds protection for theft and fire, while Comprehensive plans include accidental damage and extras like towing or lost key replacement. Premiums depend on your car’s value, age, and usage.

- Cost Factors: Premiums are influenced by your driving history, location, and vehicle type. For example, private cars typically cost 4% of their market value annually.

- Ways to Save: Install anti-theft devices for discounts, avoid filing small claims, or increase your deductible.

For a private car worth UGX 50,000,000, expect to pay around UGX 2,000,000 annually for Comprehensive insurance. Compare providers and policy details carefully to find the best fit for your needs.

Uganda Car Insurance Types and Costs Comparison 2026

Mandatory Third-Party Insurance and Average Costs

What Third-Party Insurance Covers

Under Uganda’s Motor Vehicle Insurance (Third Party Risks) Act, Cap 214, all private and commercial vehicles, including motorcycles, must carry valid third-party insurance. The only exception to this rule applies to government-owned vehicles.

This insurance provides protection against legal liability if your vehicle causes harm or damage to others. Specifically, it covers incidents involving death or bodily injuries to pedestrians, passengers, or other drivers, as well as damage to third-party property. However, it does not extend to cover damage to your own vehicle, theft, fire, or any injuries you might suffer yourself. The law caps compensation at UGX 1,000,000 per injured or deceased individual, with a maximum of UGX 10,000,000 per accident.

Failing to have proper coverage can lead to serious consequences. Penalties include a fine of up to UGX 100,000 (about $27), imprisonment for up to two years, and a mandatory one-year driving ban. To enforce compliance, police use the Express Penalty System to instantly check a vehicle’s insurance status.

Now that we’ve outlined what third-party insurance covers, let’s look at the costs for 2026.

2026 Third-Party Insurance Costs

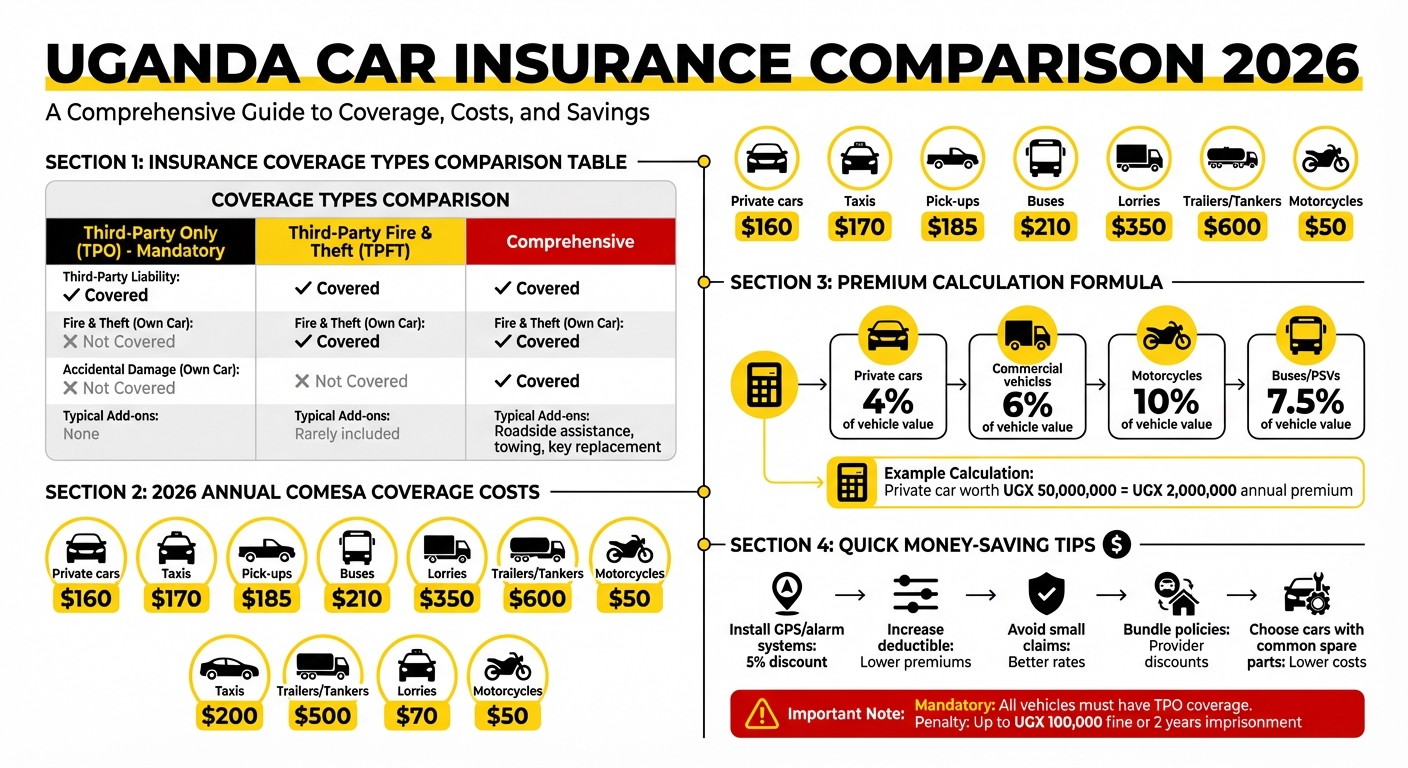

The cost of third-party insurance in Uganda varies based on factors like vehicle type, engine capacity, and how the vehicle is used. While domestic premiums are quoted in Ugandan Shillings, the rates for COMESA extensions, which allow cross-border travel, are listed in U.S. dollars. NIC Uganda provides the following annual COMESA coverage estimates for 2026:

- Private cars: $160

- Taxis: $170

- Pick-ups: $185

- Buses: $210

- Lorries: $350

- Trailers or tankers: $600

- Motorcycles: $50

Domestic-only policies are generally cheaper than COMESA coverage, while commercial vehicles incur higher premiums.

HOW DOES MOTOR VEHICLE INSURANCE WORK IN UGANDA?

Optional Insurance Coverage and Pricing

In Uganda, drivers have the option to go beyond the mandatory third-party insurance by choosing either Third-Party Fire and Theft (TPFT) or Comprehensive coverage. TPFT expands the basic third-party coverage to include protection against theft and fire damage, making it particularly valuable in high-risk urban areas. These options provide additional layers of security, safeguarding your vehicle investment.

Comprehensive insurance takes it a step further. It not only includes TPFT benefits but also covers accidental damages, even when the driver is at fault. Additional perks often include services like wreckage removal, towing, lost key replacement, and coverage for damages caused by riots or strikes. According to the Insurance Regulatory Authority (IRA), these policies typically cap driver medical expenses and authorized repair costs at UGX 2,000,000 (approximately $540), with similar limits for windscreen replacements.

Premiums and Discounts

The cost of optional coverage is determined by factors such as the vehicle’s value, age, and usage. Premiums are calculated individually based on these variables. Comprehensive policies may also include third-party liability coverage of up to UGX 100,000,000 (around $27,000) for property damage and bodily injury. Deductibles are typically set at 10% for damage (with a minimum of UGX 100,000) and 15% for theft. Additionally, drivers under the age of 21 or those with less than a year of driving experience often face a 20% surcharge.

However, there are opportunities for savings. For instance, installing a GPS tracking system or an alarm can qualify drivers for a 5% discount on basic premiums. Optional add-ons, such as Political Violence and Terrorism (PVT) coverage, usually increase the base premium by 10%.

Coverage and Add-ons Overview

The table below provides a quick comparison of the different coverage types and their typical add-ons:

| Coverage Type | Third-Party Liability | Fire & Theft (Own Car) | Accidental Damage (Own Car) | Typical Add-ons |

|---|---|---|---|---|

| Third-Party Only (TPO) | Covered | Not Covered | Not Covered | None |

| Third-Party Fire & Theft | Covered | Covered | Not Covered | Rarely included |

| Comprehensive | Covered | Covered | Covered | Roadside assistance, towing |

This range of options allows drivers to tailor their insurance to their specific needs, balancing coverage and cost effectively.

Factors That Affect Car Insurance Prices

In Uganda, insurers consider a variety of factors when calculating your car insurance premium. Knowing these factors can help you estimate your costs and even find ways to lower your rates. Let’s take a closer look at what influences your premium.

Vehicle Type and Age

The type, model, and age of your car play a big role in determining your insurance costs. Insurers classify vehicles into categories like Private, Commercial, or Other, depending on how they’re used. Newer and more expensive cars generally come with higher premiums because repairs or replacements cost more.

The availability of spare parts also matters. Cars with widely available local parts – like the Toyota Harrier, Subaru Forester, Nissan X-Trail, and Honda CR-V – often have lower premiums. On the other hand, vehicles that require rare or imported parts may lead to higher insurance costs.

If you own an older or second-hand car, some insurers may ask for an engineer’s report and a copy of the current logbook before issuing a policy.

Driver’s Age and Experience

Your driving history and personal profile also impact your premium. A clean driving record typically results in lower costs, while frequent or even minor claims can drive up your rates at renewal time. For small damages, it might be better to pay out-of-pocket instead of filing a claim, as this can help keep your premiums down. A strong claims history benefits all types of policies and can lead to noticeable savings.

Location and Usage

Where and how you drive your car also influence your insurance costs. Urban areas like Kampala, with their high traffic and greater risk of theft, usually mean higher premiums. Insurers assess the risk level of different locations, so cars parked or driven in high-risk areas often come with steeper rates. Similarly, commercial vehicles operating in busy cities tend to have higher premiums compared to private-use vehicles.

If you move from a high-risk area, such as Kampala, to a less busy rural district, inform your insurer. This change could potentially lower your premium.

sbb-itb-7bab64a

Insurance Provider Comparison

Now that we’ve explored the factors that influence premiums, let’s take a closer look at some of the major insurance providers in Uganda. The country’s insurance market offers a range of options, each with distinct coverage plans and pricing structures. This breakdown can help you find coverage that aligns with your budget and specific needs.

NIC (National Insurance Corporation) offers three straightforward tiers: Third Party Risk Only, Third Party Fire and Theft, and Comprehensive. For Third Party coverage, property damage is capped at UGX 10,000,000, while bodily injury and death have no limits. NIC also provides flexible short-term rates, such as 15% of the annual premium for up to 20 days, or 70% for six months. This flexibility is ideal if you need temporary coverage.

PAX Insurance stands out with its Motor Comprehensive policy, which includes protection against natural disasters like floods, hurricanes, storms, and earthquakes. It also comes with a standard windscreen extension. With a user rating of 4.5/5, PAX is known for offering customizable options that cater to different budgets. Meanwhile, CIC Uganda provides a "Motor Enhanced Third Party" plan. This option is a middle ground between basic Third Party coverage and full Comprehensive insurance, giving drivers who can’t afford comprehensive plans a higher level of protection than the legal minimum.

Stanbic Bank‘s Bancassurance program calculates premiums as a percentage of the vehicle’s value: 4% for private cars, 6% for commercial vehicles, 7.5% for PSVs and buses, and 10% for motorcycles. Additional benefits include medical coverage up to UGX 2,000,000 and a 14-day rental car allowance at UGX 100,000 per day during repairs. They also offer the option to split premium payments into three installments over 60 days, making it easier to manage costs.

When comparing providers, don’t just focus on the base premium. Take a closer look at what’s included, such as windscreen damage, wreckage removal, or key replacement, and what might come with extra fees. Carefully evaluate these details to find the provider that best fits your financial and coverage needs.

How to Calculate and Lower Your Insurance Costs

Calculating Your Insurance Costs

In Uganda, insurers typically calculate comprehensive insurance premiums as a percentage of your vehicle’s market value. Here’s a general breakdown: private cars are around 4% of the vehicle’s value annually, commercial vehicles hover near 6%, motorcycles average about 10%, and buses or PSVs settle at approximately 7.5%. For example, if you own a private car valued at UGX 50,000,000, your annual premium would be roughly UGX 2,000,000.

To get an accurate estimate, you’ll need key details like the vehicle’s year of manufacture, its classification (private, commercial, or PSV), and its current market value. Once you have this information, you can start exploring ways to bring those costs down.

Ways to Reduce Your Premiums

Here are some practical tips to help cut down on your insurance costs:

- Increase Your Deductible: Opting for a higher deductible lowers your annual premium, though it means you’ll pay more out of pocket if you make a claim.

- Install Anti-Theft Devices: Adding features like GPS trackers or alarm systems can qualify you for discounts, as they reduce the risk of theft.

- Avoid Filing Small Claims: Keeping a clean claims history helps stabilize your premiums over time.

- Bundle Your Policies: Combining multiple insurance policies under the same provider often leads to discounts.

- Choose Vehicles with Common Spare Parts: Cars like many Toyota models, which have widely available spare parts, tend to cost less to repair, leading to lower insurance premiums.

Conclusion

Car insurance in Uganda is more than just meeting legal requirements – it’s a safety net that protects you from unexpected expenses on the road. While comprehensive policies go beyond the basics, offering broader coverage, the cost of premiums depends on factors like your vehicle’s age, your driving record, and how you use your car. As the market evolves, so do the options available to drivers.

Looking ahead to 2026, trends point to more personalized policies and bundled services, giving you greater flexibility in coverage. This shift is fueled by a growing middle class and rising vehicle ownership, making it easier than ever to find insurance that aligns with your budget and lifestyle needs.

To make the most of your policy, ensure your insurer is licensed by the Insurance Regulatory Authority (IRA), review their claims process reputation, and carefully compare policy details. Reliable insurers typically settle claims within 5 to 7 working days. Use the premium calculation methods and cost-saving tips discussed earlier, such as installing anti-theft devices, bundling policies, or adjusting your deductible, to manage your expenses effectively.

Ultimately, comparing providers and policies is key to avoiding unnecessary costs and stress. The goal isn’t just to find the cheapest option but to secure a policy that offers the best value for your unique needs. By understanding these essential aspects, you’ll be better equipped to choose the right coverage in Uganda’s ever-changing insurance market.

FAQs

What determines the cost of car insurance in Uganda?

The cost of car insurance in Uganda is influenced by several key factors. One major consideration is your vehicle’s characteristics. Cars with larger engines, higher market values, or newer models generally come with higher insurance premiums. Additionally, the type of vehicle you drive matters – whether it’s a private car, a commercial vehicle, or a motorcycle, each classification impacts the pricing differently.

Another important factor is your driving history and profile. Experienced drivers with clean records and lower annual mileage often enjoy lower premiums. On the flip side, a history of frequent claims or past accidents can drive up costs. How you use your vehicle also plays a role. Cars used for personal commuting typically cost less to insure compared to those used for commercial purposes or ride-sharing, which usually result in higher premiums.

Finally, policy choices can significantly affect the price you pay. Factors like the deductible you choose, any optional add-ons, and discounts (such as those for anti-theft devices or bundling multiple policies) all come into play. Some insurers even offer usage-based pricing, which adjusts your premium based on driving habits like distance traveled or the time of day you’re on the road.

What are some practical ways to lower car insurance costs in Uganda?

Lowering car insurance costs in Uganda comes down to reducing risk factors and making informed decisions about your coverage. One of the first steps is comparing quotes from multiple insurance providers, as premiums can vary widely. Installing anti-theft devices, such as alarms or GPS trackers, can also make your vehicle less of a target and may qualify you for discounts. Another way to save is by bundling your car insurance with other policies, like home or health insurance, which many providers offer at reduced rates.

Opting for a higher deductible is another strategy. While this lowers your monthly premium, it does mean you’ll need to pay more out-of-pocket if you file a claim. Keeping a clean driving record is equally important – avoiding accidents and traffic violations often results in better rates. Driving a smaller-engine or newer vehicle, or using your car exclusively for personal use rather than commercial purposes, can also help lower your premiums. Lastly, think carefully about your coverage needs. If comprehensive insurance feels unnecessary, switching to third-party or third-party fire-and-theft policies can save you money while still meeting legal requirements.

What’s the difference between Third-Party, TPFT, and Comprehensive car insurance?

Third-Party insurance (TPO) is the most basic level of coverage required by law. It protects you against costs related to damage, injury, or death caused to others. However, it’s important to note that TPO does not cover any damage to your own vehicle.

Third-Party, Fire, and Theft (TPFT) insurance builds on TPO coverage. It includes everything TPO offers but adds protection for your car in case of fire or theft. That said, it still won’t cover accidental damage to your own vehicle.

Comprehensive insurance provides the broadest range of coverage. It includes third-party liability, protection against fire and theft, and also covers damage to your own car – whether from accidents, natural disasters, or other risks. Many comprehensive plans even come with extra benefits, like roadside assistance, for added convenience.

Related Blog Posts

- Car insurance prices in Uganda

- Car Price Trends in Uganda: Used vs New (2025 Update)

- Comprehensive car insurance in Uganda: What to know in 2025

- What is the cost of comprehensive car insurance in Uganda?