In Uganda’s 2026 car market, automatic transmissions dominate resale value, especially in urban areas like Kampala. Automatics now account for 92% of vehicles listed for sale, driven by urbanization, traffic conditions, and the popularity of Japanese imports. Buyers favor automatics for their convenience in city driving, while manuals remain a niche choice for rural and commercial use due to their durability and simpler maintenance.

Key findings:

- Automatics: Popular in cities for ease of use; models like the Toyota Premio and Subaru Forester hold strong resale value.

- Manuals: Preferred for rugged terrain and commercial use; vehicles like the Toyota Land Cruiser and Hilux are highly sought after.

- Hybrid automatics: Gaining traction with fuel efficiency of 22–25 km/l, offering lower running costs.

Quick Comparison:

| Transmission Type | Best Use Case | Resale Value Trends | Popular Models |

|---|---|---|---|

| Automatic | Urban driving | Higher resale in cities; broad demand | Toyota Premio, Subaru Forester |

| Manual | Rural/commercial | Strong resale for heavy-duty purposes | Toyota Land Cruiser, Toyota Hilux |

Conclusion: Automatics lead Uganda’s resale market in 2026, but manuals still shine in specific niches like off-road and commercial vehicles.

Automatic vs Manual Car Resale Values in Uganda 2026

Here is why you don’t want to buy a manual car in Uganda

Market Demand for Automatic and Manual Cars in Uganda

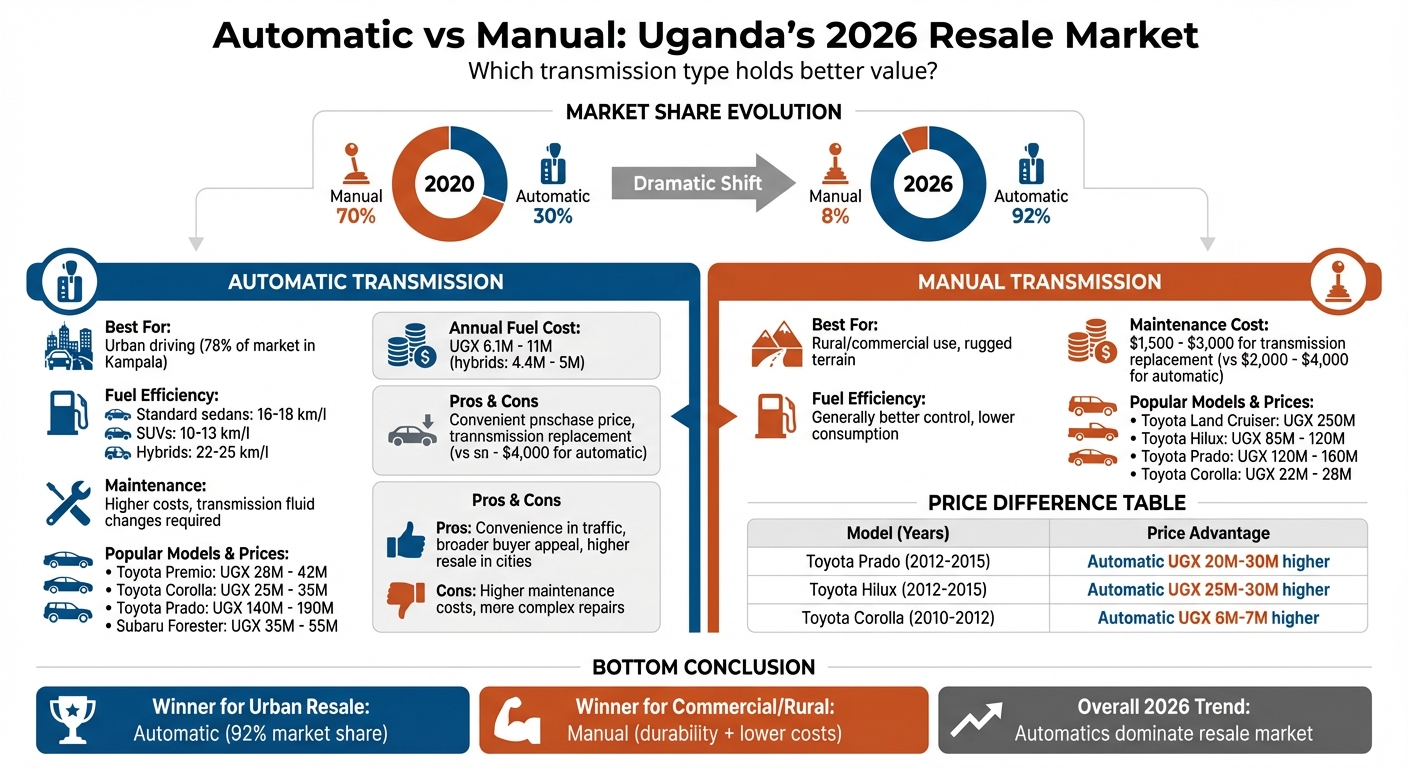

Uganda’s car market has seen a dramatic shift in transmission preferences over recent years. Back in 2020, manual cars dominated the market, accounting for 70% of vehicles sold. Fast forward to January 2026, and the landscape looks entirely different – automatic transmissions now make up about 92% of the vehicles available in Kampala. This shift reflects how urbanization and changing import trends have reshaped buyer preferences, highlighting the contrasting needs of urban and rural consumers.

Urban areas, particularly Kampala, are driving this change. Nearly 78% of the used car market activity is concentrated in the city, where the stop-and-go nature of traffic makes automatic transmissions the practical choice. Younger professionals and middle-class buyers are especially drawn to compact automatics like the Honda Fit and Toyota Corolla, which dealers promote as ideal for city life. Meanwhile, manual transmissions are now more of a niche option, primarily found in commercial vehicles like the Toyota Hilux and Isuzu D-Max or rugged off-roaders such as the Toyota Land Cruiser Hardtop.

2026 Market Trends and Buyer Preferences

As this market transformation continues, buyer preferences have become distinctly divided between urban and rural areas. In Kampala, where traffic congestion is a daily reality, automatics dominate car sales. Models like the Toyota Harrier and Subaru Forester are particularly popular, offering the convenience and style that urban drivers value. On the other hand, rural buyers and commercial operators still lean toward manual vehicles, appreciating their durability and ability to handle rough, unpaved roads.

This urban dominance of automatics has made it increasingly difficult for buyers to find manual cars for personal use. This shift also has implications for resale values, as the demand for each transmission type continues to evolve.

How Car Imports Affect Availability

The growing preference for automatics isn’t just about urban convenience – it’s also tied to changes in car import practices. Most modern Japanese consumer vehicles, which dominate Uganda’s imports, are manufactured as automatics. This creates a reinforcing cycle: Japanese exports favor automatics, Ugandan imports reflect this trend, and buyers adapt their choices accordingly.

Government policies further drive this shift. Uganda’s 15-year age limit on vehicle imports ensures that the market leans toward newer models, which are predominantly automatic. Import taxes also play a role; buyers face a 25% customs duty, a 20% excise duty, and a 16% VAT on imported vehicles. Additionally, an environmental levy on cars older than eight years nudges buyers toward newer, automatic models. Together, these factors not only shape buyer preferences but also influence the resale dynamics of both manual and automatic vehicles in Uganda.

Resale Value Factors for Automatic Transmission Cars

Let’s take a closer look at what makes automatic transmission cars a strong contender in Uganda’s resale market.

Automatic transmission vehicles have carved out a solid position in Uganda’s resale scene, even though they come with higher maintenance costs. Thanks to the influx of Japanese imports, automatics have become the standard, especially in urban areas where their demand remains consistently high.

Why Automatics Are Popular in Cities

Urban centers like Kampala are perfectly suited for automatic cars. The relentless stop-and-go traffic and the city’s hilly terrain make automatics a practical choice for daily commutes. Without the need for constant gear shifting, drivers can navigate congested roads with ease, which explains their popularity and strong resale value.

Take well-loved models like the Toyota Corolla and Toyota Premio, for instance. Both are considered wise investments in Uganda’s car market. The Toyota Corolla typically resells for UGX 25 million to 35 million, while the Premio fetches between UGX 28 million and 42 million, depending on its condition and year. Adding to their appeal is the availability of spare parts in key cities like Kampala, Jinja, and Entebbe, which lowers maintenance costs by about 20% compared to European models. However, owning an automatic does come with its own set of maintenance considerations.

Maintenance and Fuel Costs for Automatics

While automatics dominate urban markets, their cost factors significantly influence their resale potential. With fuel prices hitting UGX 5,500 per liter in 2025, buyers are increasingly prioritizing fuel efficiency.

Modern automatic sedans typically deliver 16–18 kilometers per liter. For someone driving 20,000 kilometers annually, this translates into fuel costs of roughly UGX 6.1 million to 6.9 million. On the other hand, larger automatic SUVs consume fuel at 10–13 kilometers per liter, leading to annual costs ranging from UGX 8.5 million to 11 million.

Routine maintenance is critical to keeping automatics running smoothly. Regular transmission fluid changes are a must to avoid expensive repairs. Additionally, using high-quality fuel from trusted providers like Shell or Total can help prevent engine deposits, which can harm the performance of automatics and hybrid systems.

Interestingly, hybrid automatics are becoming a popular choice among Ugandan buyers. Models like the Toyota Prius and Nissan Note e-Power, which offer an impressive 22–25 kilometers per liter, are particularly appealing. These hybrids can cut annual fuel costs to around UGX 4.4 million to 5 million, making them a cost-effective option with excellent resale potential.

Resale Value Factors for Manual Transmission Cars

Manual transmission cars have a distinct appeal, especially for commercial operators, rural drivers, and budget-conscious buyers. These vehicles hold their own in the resale market thanks to their straightforward mechanics and affordability, which often outweigh the convenience of automatics. In Uganda, where unpaved roads, steep inclines, and rugged terrain are common, the precise control offered by manual transmissions becomes a practical necessity. Let’s break down the key reasons why manual cars retain their value.

Lower Purchase Prices for Manual Cars

Manual cars are generally more affordable upfront because they rely on simpler machinery with fewer components. In Uganda, where 67% of cars are priced between UGX 800,000 and UGX 20,000,000, this affordability keeps demand steady.

For instance, in January 2026, a 2012 Daihatsu Hijet manual was priced between UGX 29 million and UGX 31 million, while a 2014 Suzuki Swift manual was available for UGX 36.64 million. This price range makes manual cars an attractive option for first-time buyers and small business owners seeking dependable and cost-effective transportation. Even though manual cars may sell for less than automatics, their accessibility ensures a consistent resale market.

Simpler Maintenance and Repairs

Another advantage of manual cars is their lower maintenance and repair costs. Replacing a manual transmission typically costs between $1,500 and $3,000, whereas automatic transmission repairs can range from $2,000 to $4,000. In Uganda’s challenging driving conditions – marked by potholes, flooding, and rough terrain – this cost difference becomes a major selling point.

"Manual cars are often perceived as more reliable than automatic vehicles due to their simpler mechanics. This reliability can be particularly important in remote areas of Uganda, where access to repair services may be limited."

– Supreme Car Rental Uganda

Local mechanics are well-versed in fixing manual gearboxes, thanks to their straightforward design and minimal reliance on electronics. This simplicity not only reduces repair costs but also ensures quicker diagnostics and fixes. For commercial operators managing taxi fleets or delivery vehicles, this translates to reduced downtime and operating expenses. These factors make manual cars a practical choice, helping maintain their resale value when it’s time to upgrade to newer models.

Resale Price Comparison: Automatic vs Manual

When it comes to resale prices, the differences between automatic and manual vehicles are striking and heavily influenced by the type and purpose of the vehicle. SUVs and pickups tend to show larger price disparities compared to compact sedans.

Take the Toyota Hilux, for example. Manual versions, often used as rugged work vehicles, are priced between UGX 85 million and UGX 120 million for models from 2012 to 2015. On the other hand, automatic versions, which are typically marketed as family-friendly, urban lifestyle vehicles, command a premium of UGX 25M–30M more.

The Toyota Corolla paints a different picture. For the 2010–2012 models, automatic versions resell for UGX 28 million to UGX 35 million, while manual versions go for UGX 22 million to UGX 28 million. This results in a much smaller gap of just UGX 6 million to UGX 7 million.

Price Comparison Table by Model

Here’s a breakdown of the resale price differences for some popular models:

| Model | Year Range | Automatic Resale Price | Manual Resale Price | Price Difference |

|---|---|---|---|---|

| Toyota Prado | 2012–2015 | UGX 140M – 190M | UGX 120M – 160M | UGX 20M – 30M |

| Toyota Hilux | 2012–2015 | UGX 110M – 150M | UGX 85M – 120M | UGX 25M – 30M |

| Toyota Corolla | 2010–2012 | UGX 28M – 35M | UGX 22M – 28M | UGX 6M – 7M |

| Toyota Harrier | 2008–2010 | UGX 45M – 60M | Rarely Available | N/A |

The Toyota Harrier highlights another trend in the market: certain SUVs, particularly those favored in urban areas, are almost exclusively imported as automatics. This lack of manual options makes direct price comparisons difficult. For buyers, this scarcity often solidifies the automatic’s dominance in the resale market, as they have fewer choices when looking for specific models.

sbb-itb-7bab64a

Top Automatic Cars with High Resale Value

Based on market trends and resale patterns, these automatic models stand out as Uganda’s top choices for retaining high resale value in 2026.

The Toyota Prado takes the lead in Uganda’s resale market for automatics. Starting at UGX 55 million, it’s celebrated for its durability and reputation as a symbol of prestige. Toyota’s dominance in Uganda’s automotive sector further solidifies its popularity.

The Subaru Forester is another standout, priced between UGX 35 million and UGX 55 million. Its symmetrical all-wheel-drive system and high ground clearance make it ideal for navigating both urban streets and rural terrains, ensuring strong resale appeal.

For families and commercial use, the Toyota Noah is a top contender. With prices ranging from UGX 30 million to UGX 45 million, its spacious seven-seater layout, sliding doors, and efficient 1.8L engine strike a balance between practicality and fuel economy.

The Toyota Harrier is a favorite among professionals who value comfort and style. Its resale prices range from UGX 45 million to UGX 70 million, reflecting its appeal to a more upscale market.

Compact options like the Toyota Corolla and Toyota Premio also hold their ground in resale value. The Corolla, priced between UGX 25 million and UGX 35 million, and the Premio, ranging from UGX 28 million to UGX 42 million, are known for their reliability and low maintenance costs. These qualities make them reliable choices as Uganda’s market increasingly moves toward automatic vehicles.

Top Manual Cars with High Resale Value

When it comes to manual cars with impressive resale value in Uganda, a few models consistently stand out. Manual transmission vehicles, especially those built for durability and tough terrains, remain highly valued in the market.

The Toyota Land Cruiser is a clear leader in this category. A 2020 Double Cabin manual model can fetch as much as UGX 250 million ($69,444). Known for its exceptional durability and off-road prowess, this vehicle is a top pick for buyers who prioritize reliability in challenging environments.

Another standout is the Toyota Hilux, a popular workhorse. Even older models, like the 2008 version, can command around UGX 80 million ($22,222). Its reliability and the easy availability of spare parts make it a trusted option for heavy-duty use and long-distance travel across diverse terrains.

For those looking for a combination of modern features and manual control, the Isuzu D-Max is a strong contender. A 2023 model equipped with a 3.0L diesel engine and manual transmission is priced at approximately UGX 150 million ($41,667). Its blend of durability and modern utility makes it a popular choice for buyers seeking versatility.

Compact cars also hold their own in the manual resale market. The Toyota Fielder, known for its excellent fuel efficiency and cargo space, remains in demand. A 2010 model typically resells for about UGX 40 million ($11,111). Similarly, the Toyota Auris, favored for its reliability and adaptability to both city and rural roads, commands around UGX 48 million ($13,333) for the same year.

Adding to the list of rugged options, the Nissan X-Trail deserves a mention. Its all-wheel-drive capability and durability make it a strong competitor in this segment. Japanese brands like Toyota and Nissan dominate the market due to their ability to handle local terrains and their consistently high resale values.

Which Transmission Type Will Resell Better in 2026?

By 2026, automatic transmissions are set to dominate Uganda’s resale market, reflecting a major shift in buyer preferences. Dealer listings from January 2026 show that automatics now make up over 92% of available inventory, a dramatic jump from just 30% in 2020. This surge highlights the growing demand for vehicles that prioritize ease of use.

Automatics enjoy a clear edge in urban areas, where their convenience in heavy traffic appeals to a wide range of buyers. New drivers, families with multiple drivers, and professionals seeking comfort all gravitate toward automatics, making them a popular choice for resale in cities. This broad appeal has significantly boosted their resale performance. However, the picture isn’t the same across all vehicle categories.

Manual transmissions, on the other hand, continue to shine in specific niches. Vehicles like heavy-duty pickups, 4×4s, and commercial models still command high resale values when equipped with manuals. For instance, the Toyota Land Cruiser, priced at approximately UGX 250 million (≈$69,444), and the Isuzu D-Max, around UGX 150 million (≈$41,667), remain sought after for their durability on rugged terrain and easier, cost-effective repairs.

Market trends consistently show that transmission type plays a critical role in resale strategy. Automatics dominate urban resale markets with models like the Toyota Premio, Harrier, and Nissan X-Trail, thanks to their ease of use and wide appeal. In contrast, rural and commercial buyers lean toward manuals, favoring models like the Toyota Hilux and Land Cruiser for their reliability and lower maintenance costs.

The rising popularity of hybrid vehicles further strengthens the case for automatics. With fuel prices hovering around UGX 5,500 per liter (≈$1.53), hybrids – offered exclusively with automatic transmissions – deliver superior fuel efficiency, averaging 22–25 km/l compared to 16–18 km/l for standard manuals. As charging infrastructure improves, the hybrid segment is expected to further cement the dominance of automatics in Uganda’s resale market.

Conclusion

When it comes to the resale value of automatic versus manual transmissions in Uganda, it all boils down to your target buyer and where the vehicle will be used. If you’re selling in urban areas, an automatic transmission could appeal to a broader audience, thanks to its convenience in city driving.

On the other hand, manual transmissions hold their worth in commercial and off-road settings. Their simpler mechanics and lower repair costs make them a practical choice. Take, for example, vehicles like the Toyota Land Cruiser – priced around UGX 250 million (≈$69,444) – or the Toyota Hilux. These models show that manuals can still fetch a strong resale value when paired with the right buyer and purpose.

Resale trends in Uganda often mirror the needs of urban versus rural markets. In cities, automatics are more marketable, while manuals shine in upcountry regions or for commercial use, where ease of maintenance is a priority. Opting for popular brands like Toyota, Nissan, or Subaru can also be a smart strategy, as their widespread availability of spare parts helps ensure quicker sales and better price retention.

While manuals typically come with lower upfront and maintenance costs, automatics can command higher resale prices. This can make up for their higher initial investment, provided the vehicle is well-maintained and sold in a market that values convenience. Choosing the right transmission ultimately depends on aligning it with your driving environment and future resale goals.

FAQs

Why are automatic cars more popular in Uganda’s cities?

Automatic cars are gaining traction in Uganda’s urban areas, and it’s easy to see why. They simplify the challenge of driving in heavy traffic, eliminating the need for constant clutching and shifting that comes with manual cars. For anyone navigating Kampala’s congested streets, this can be a huge relief.

What’s more, modern automatic transmissions have become much more fuel-efficient, closing the gap with their manual counterparts. This improvement makes them an even more practical choice for city driving. On top of that, many rental companies and ride-hailing services in Kampala primarily offer automatic vehicles. This means even those unfamiliar with manual transmissions can easily get behind the wheel, adding to their growing popularity in city life.

How do Uganda’s import policies impact car resale values?

Uganda’s import policies play a big role in shaping car resale values. By controlling which vehicles can enter the country and the costs tied to importing them, these regulations create a market dynamic that favors certain types of cars. For instance, vehicles older than 15 years are not allowed, and all imports must meet Euro 4 emissions standards and pass a road-worthiness inspection. This means the market leans toward newer, more dependable models, which tend to hold their value better over time.

On top of that, import taxes and fees – like duties, excise tax, VAT, and registration costs – have a direct effect on resale prices. The Uganda Revenue Authority (URA) uses valuation methods that often result in higher tax assessments, which increases the cost of bringing cars into the country. These added expenses are typically passed on to buyers, squeezing profit margins for sellers.

Because of this, vehicles that meet these regulations – such as newer Japanese models with readily available spare parts – are more likely to maintain strong resale value. On the other hand, older or non-compliant cars see faster depreciation and struggle to attract buyers in the market.

Why do manual cars tend to have higher resale value in rural areas of Uganda?

Manual cars tend to hold their resale value better in rural parts of Uganda, largely because they cater perfectly to the needs of buyers looking for cost-effective solutions. These cars are generally less expensive, sturdier, and more fuel-efficient, making them well-suited for covering long distances on rugged, unpaved roads. Many of these vehicles, often Japanese imports with manual transmissions, are also easier to maintain, thanks to the widespread availability of spare parts, which helps keep maintenance costs manageable.

Another important reason is the simplicity of manual transmissions compared to automatics. Their mechanical design is easier to repair, which is a big advantage in areas where access to professional repair services is limited. Coupled with a strong demand in the used car market, manual vehicles remain a smart and practical option for rural buyers.

Related Blog Posts

- Cheapest used cars in Uganda 2025

- Most popular cars in Uganda

- SUV sales trends in Uganda

- Manual or Automatic: Which Cars Are Better for Ugandan Drivers?