Buying a car in Uganda involves understanding import rules, taxes, and market trends. Here’s a quick overview:

- Import Rules: Cars must be right-hand drive and no older than 15 years.

- Taxes: Key costs include Import Duty (25% of CIF), VAT (18% of CIF + Import Duty), Withholding Tax (6%), and Environmental Levy (varies by engine size).

- Documents Needed: Bill of Lading, Import Declaration Form, Certificate of Conformity, Purchase Invoice, and Export Certificate.

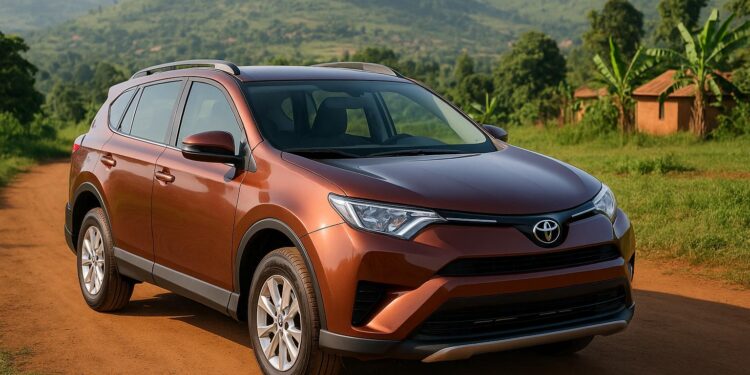

- Popular Cars: Toyota Land Cruiser, RAV4, and Harrier are top choices due to durability and availability of spare parts.

- Costs: For example, a 2012 Toyota Noah costs about $11,800, while a 2025 BYD Leopard 5 starts at $22,200.

Pro Tip: Use the Uganda Revenue Authority (URA) online calculator to estimate import costs and ensure compliance with regulations. For smoother transactions, consider working with registered exporters and clearing agents.

Car Import Steps

Import Process Steps

Bringing a car into the country involves a few straightforward steps. First, select a supplier from export markets such as Japan, the UK, Dubai, or South Africa. Ensure the supplier provides the necessary Pre-Export Verification of Conformity (PVoC).

Next, use the URA online calculator to estimate the total import costs. For shipping, opt for RoRo (Roll-on/Roll-off) for standard vehicles or container shipping if you’re importing a higher-end model. Be sure to collect all required documents in advance to avoid customs delays.

Required Import Papers

To clear customs, you’ll need the following documents:

- Bill of Lading (BOL): Serves as proof of the shipping contract and vehicle ownership.

- Import Declaration Form (IDF): Contains details about the vehicle’s specifications.

- Certificate of Conformity (COC): Verifies that the vehicle complies with Ugandan standards.

- Purchase Invoice: The original document showing proof of purchase and vehicle details.

- Export Certificate: Provided by the country where the vehicle originated.

Customs clearance can be completed at Mombasa port or Uganda’s inland depots. Keep in mind that all imported vehicles must be right-hand drive unless they serve a special purpose. Additionally, vehicles cannot be older than 15 years from their manufacturing date.

Laws and Taxes

Import Costs Breakdown

When importing vehicles, taxes are calculated based on the vehicle’s CIF (Cost, Insurance, and Freight) value:

| Tax/Fee Type | Percentage | Base for Calculation |

|---|---|---|

| Import Duty | 25% | CIF Value |

| VAT | 18% | CIF + Import Duty |

| Import Commission | 2% | Dutiable Value |

| Excise Duty* | 10% | Specific vehicle categories |

| Withholding Tax (Individual) | 6% | Transaction Value |

| Withholding Tax (Business) | 15% | Transaction Value |

*Excise duty applies only to certain types of vehicles.

The Uganda Revenue Authority (URA) uses the General Agreement on Trade and Tariffs (G.A.T.T) valuation method to determine the dutiable value. Additionally, keep in mind that regulations like age limits can affect the eligibility of your vehicle for import.

15-Year Age Limit Rules

As of July 4, 2023, Uganda has implemented a 15-year age limit for imported vehicles. This policy aims to maintain vehicle quality and reduce environmental harm.

"The Uganda National Bureau of Standards (UNBS) has appointed EAA to conduct a compulsory Road Worthiness Inspection (RWI) for used cars".

Local Inspection Payments

After importing your vehicle, you must complete several inspections:

-

Pre-Export Verification

This step must be completed before shipping the vehicle. Fees depend on the vehicle’s type and country of origin. -

Customs Clearance

Submit all required documents and pay the necessary taxes during this process. -

Road Worthiness Inspection

This inspection ensures the vehicle complies with Ugandan safety standards. An Environmental Levy is also charged, based on the engine size and age of the vehicle.

Make sure to process all inspection payments through approved channels and keep all related receipts. For the latest fee details and accepted payment methods, visit the URA website.

Car Registration Guide

Registration Process

The Uganda Revenue Authority (URA) provides an online portal to make the vehicle registration process easier. To get started, you’ll need the following documents:

| Required Documentation | Purpose/Use |

|---|---|

| Tax Identification Number (TIN) | Identifies you or your business |

| Import Declaration Form (IDF) | Confirms legal import of the vehicle |

| Certificate of Conformity (COC) | Ensures the vehicle meets standards |

| Insurance Certificate | Shows proof of vehicle insurance |

| Certificate of Origin | Confirms the vehicle’s origin |

| Bill of Lading | Provides shipping details |

| Proof of Ownership | Verifies purchase of the vehicle |

| Identity Documentation | Copy of passport or ID |

Registration fees depend on the type of vehicle:

- Standard vehicles: 800,000 UGX (about $215)

- Heavy goods vehicles: 1,100,000 UGX (about $295)

Before completing the registration process, it’s essential to confirm the vehicle’s background.

Car History Checks

Use the URA’s online system to check the vehicle’s history. This step ensures the vehicle has no unpaid debts, hasn’t been reported stolen, and that all provided documentation is accurate.

Registration Timeline

Once the vehicle’s history has been verified, follow these steps to complete registration:

-

Online Application Submission

Upload all required documents through the URA portal (www.ura.go.ug). You’ll receive a unique acknowledgment number for tracking. -

Document Verification

The submitted documents are reviewed for compliance within 24 hours. -

Final Approval

If everything is in order, the registration process is completed in under 48 hours. You’ll receive a registration number and certificate.

To avoid mistakes or delays, consider using a clearing agent to handle the paperwork.

Choosing the Right Car

Road Readiness Factors

When picking a car for Uganda’s diverse terrain, ground clearance is key. Higher clearance makes it easier to handle unpaved roads and occasional flooding during rainy seasons. Look for vehicles with a strong suspension system and underbody protection to endure rough conditions without frequent damage. These features can make a huge difference in both safety and comfort.

Top Cars in Uganda

SUVs are a favorite choice for Ugandan drivers because they handle tough roads well and offer durability. Popular models like the Toyota Land Cruiser Prado and Toyota RAV4 stand out for their dependable performance and easy access to spare parts. Plus, they tend to hold their value over time, which is a bonus if you plan to sell later.

Car Model Comparison

When comparing models, don’t just focus on the upfront price. Consider fuel efficiency, maintenance costs, how easily you can find replacement parts, and how often the car needs servicing. Think about both urban and rural driving needs to make sure the car fits your lifestyle while staying affordable to maintain.

sbb-itb-7bab64a

Payment and Loans

Loan Types

In Uganda, car financing options cater to different budgets. Tembo Automarket offers vehicle financing with an initial deposit of UGX 10,000,000. For those with smaller budgets, Yako Microfinance provides weekly payment plans ranging from UGX 200,000 to 250,000, requiring a 25% down payment based on the vehicle’s value [7]. Be sure to include all import taxes and fees when calculating your financing needs.

It’s also important to plan how you’ll handle international money transfers to avoid unnecessary costs.

Money Transfer Tips

Exchange rates and fees can have a big impact on the total cost of international transfers. Banks often provide less favorable exchange rates compared to private forex bureaus in Kampala. To get the best rates, use newer U.S. dollar bills and explore local forex bureaus or services like Wise, which often offer competitive rates.

Secure Payment Methods

Once you’ve chosen a loan and planned your transfer, focus on secure and cost-effective payment methods. Card transactions typically come with fees between 3.5% and 5%. For large purchases, consider safer options like escrow services or bank transfers. Card payments are widely accepted in urban areas, though they may include surcharges. If you’re making substantial transactions, notify your bank about activity in Uganda and use ATMs during bank hours for added assistance.

How to Import a Car to Uganda

Next Steps

To wrap up the process, follow these steps to finalize your vehicle purchase:

First, ensure you’ve gathered all the required import documents. Use the URA online calculator to get an estimate of your total costs. When choosing a vehicle, keep Uganda’s road conditions in mind. Here are a few models that are well-suited for these conditions:

- Toyota Land Cruiser Prado: Great for handling rough terrain and rural areas.

- Toyota Harrier: Perfect for city driving and highways.

- Nissan X-Trail: A versatile choice for both urban and countryside use.

- Toyota Passo: A budget-friendly option for city commutes.

Keep in mind, imported vehicles must be right-hand drive unless they’re for specific purposes. Also, make sure to get a detailed vehicle history report to confirm its background and avoid falling victim to scams.

After clearing customs, register your vehicle through the URA portal to complete the process. This step ensures you meet all legal requirements and can start driving your vehicle on Ugandan roads.

FAQs

Why should I use a registered exporter and clearing agent when importing a car to Uganda?

Using a registered exporter and clearing agent when importing a car to Uganda offers several key benefits. First, they help ensure compliance with Uganda’s import laws and regulations, reducing the risk of delays or fines. These professionals are familiar with the documentation requirements, such as invoices, certificates of origin, and inspection reports, making the process smoother and more efficient.

Additionally, a clearing agent can handle customs duties, taxes, and registration procedures on your behalf, saving you time and effort. They also provide guidance on import costs, helping you budget more accurately. By working with trusted experts, you minimize the risk of unexpected issues and ensure a hassle-free car import experience tailored to Uganda’s specific requirements.

How can I make sure the car I’m importing meets Uganda’s 15-year age limit?

To ensure your car complies with Uganda’s 15-year age limit, check the vehicle’s manufacture date carefully. The car must have been manufactured within the last 15 years to meet the regulation. You can usually find this information on the car’s documentation, such as the title or manufacturer’s certificate.

If the date isn’t clear, consider contacting the seller or verifying the details through the vehicle identification number (VIN). Staying within this limit is crucial to avoid delays or penalties during the importation and registration process.

What should I consider when deciding between RoRo and container shipping to import a car to Uganda?

When importing a car to Uganda, choosing between RoRo (Roll-on/Roll-off) and container shipping depends on your priorities. RoRo shipping is often more affordable and faster, as vehicles are driven directly onto the ship. However, it offers less protection since the car is exposed during transit.

On the other hand, container shipping provides added security by enclosing the car in a container, which can be ideal for high-value or delicate vehicles. While this method is typically more expensive and may take longer, it ensures better protection from potential damage or theft.

Consider factors like your budget, the value of the car, and the level of security you need to make the best choice for your situation.

Related posts

- How to Import a Car to Uganda: Complete Guide 2025

- How to register a used car in Uganda

- Most popular cars in Uganda

- Importing a car to Uganda: taxes explained