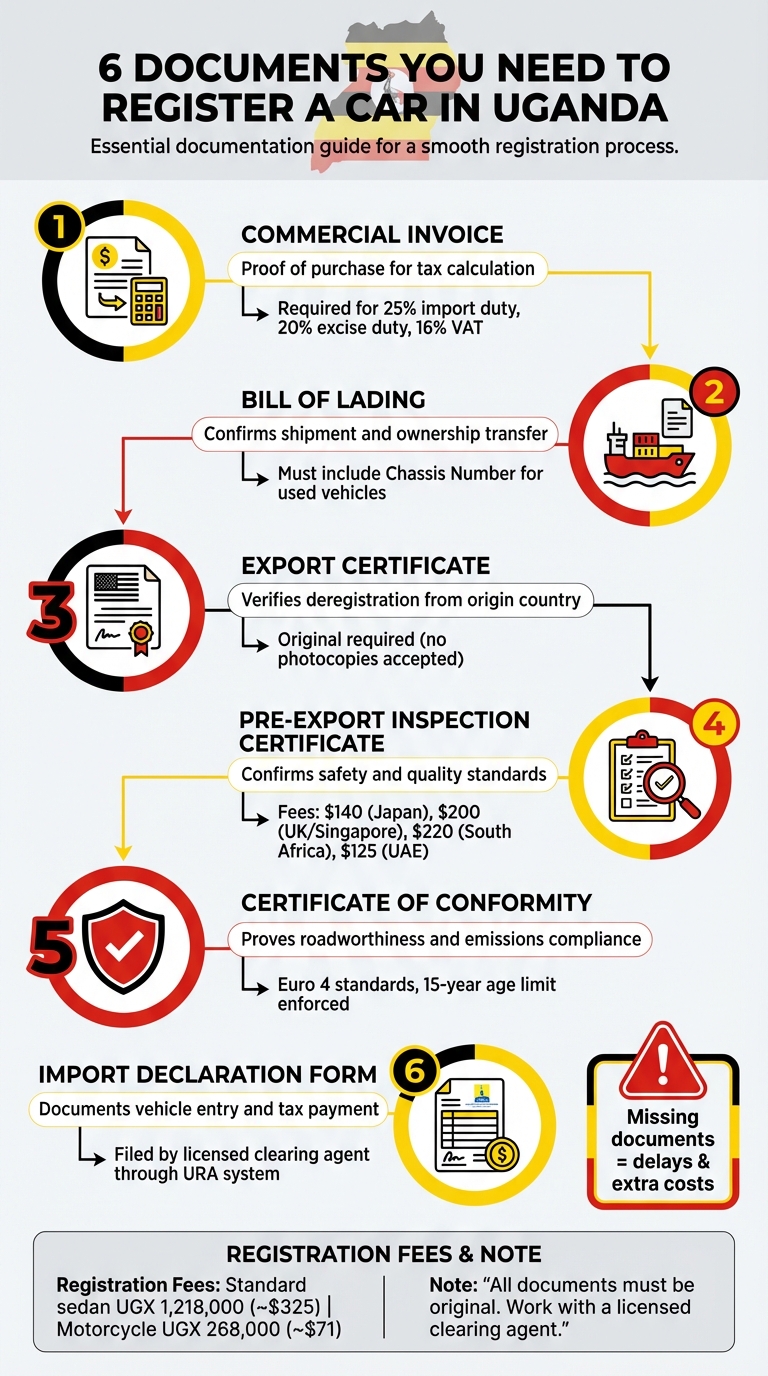

To legally register a car in Uganda, you must have six key documents. These ensure compliance with tax regulations, ownership verification, and adherence to safety standards. Here’s what you need:

- Commercial Invoice: Proof of purchase and basis for calculating taxes.

- Bill of Lading: Confirms shipment details and ownership transfer.

- Export Certificate: Verifies the car’s deregistration in its country of origin.

- Pre-Export Inspection Certificate: Confirms the vehicle meets Uganda’s safety and quality standards.

- Certificate of Conformity: Proves compliance with roadworthiness and emissions standards.

- Import Declaration Form: Documents the vehicle’s entry and ensures all taxes are paid.

Each document plays a specific role in the process, from customs clearance to final registration. Missing or incorrect paperwork can lead to delays, extra costs, or legal issues. Always double-check details like chassis numbers and work with a licensed clearing agent to streamline the process. Registration fees vary, with standard sedans costing UGX 1,218,000 (about $325) and motorcycles UGX 268,000 (about $71). Proper registration not only ensures legal compliance but also secures your ownership and simplifies future transactions.

6 Essential Documents Required to Register a Car in Uganda

1. Commercial Invoice

The commercial invoice is the cornerstone of your vehicle importation process. It serves as the main proof of purchase and is essential for calculating import taxes and duties. This document must include the vehicle’s exact purchase price, complete seller details, and accurate buyer information. URA customs officers rely on it to determine your tax obligations, making precision absolutely critical.

Uganda applies several taxes to vehicle imports: a 25% import duty, a 20% excise duty (calculated on the CIF value plus import duty), and a 16% VAT. Even a small error in the purchase price can lead to incorrect tax calculations, potential refund claims, and frustrating delays. The URA explains:

"The refund for these taxes [Motor Vehicle] will majorly occur when the taxpayer has paid more taxes exceeding his/her tax liability. This could arise due to… Mistake in registration of payment i.e. wrong figure, wrong TIN, wrong tax head, wrong name."

To avoid such issues, ensure the Taxpayer Identification Number (TIN) is accurate and matches the buyer’s name as listed in your registration records. The URA emphasizes:

"Any person who is likely to transact in any tax related business with URA, shall be required to apply for a TIN. The TIN is therefore an administrative requirement and applies to all taxpayers, regardless of the tax transaction."

Additionally, verify that the chassis number on the invoice aligns with those on your Bill of Lading and Export Certificate. Any discrepancies could result in delays and added costs. Always use the original supplier invoice, as required by the URA.

For added assurance, have a licensed clearing agent review your invoice details before submission at www.ura.go.ug. They can help confirm accuracy and ensure the correct tax head is selected. Getting the invoice right is a vital step that lays the groundwork for all the subsequent registration documents.

2. Bill of Lading

The Bill of Lading (BoL) is a critical document for shipping, confirming the shipment details and legal transfer of ownership. For imported used vehicles, it also includes essential information like the Chassis Number. Without this document, authorities won’t release your vehicle at the port. Additionally, the BoL provides the Uganda Revenue Authority (URA) with the initial details needed to set up your vehicle’s ownership records.

The URA uses the BoL to officially register your vehicle’s details for the first time, which becomes the foundation of your ownership record. As Dignited explains:

"A motor vehicle user can easily claim ownership of their own vehicle or be the title owner since owner details are captured first time on the entry of vehicle details in the URA system."

For used vehicles, the BoL must list the Chassis Number to be valid for registration. Customs officers at URA will verify this number against your Commercial Invoice and Export Certificate to ensure everything matches. Any discrepancies can delay the clearance process and result in costly port storage fees. To avoid setbacks, double-check that the Chassis Number and owner details on your BoL match those on your other import documents.

Only original copies of the Bill of Lading are accepted – photocopies or scanned versions won’t suffice. Missing originals can lead to delays and added expenses during the port clearance process. To ensure a smooth experience, coordinate with your clearing agent ahead of time to manage port charges and arrange transport.

3. Export Certificate

The Export Certificate is a crucial document issued by the vehicle’s country of origin – like Japan – that confirms the car has been deregistered for export. It also verifies the vehicle’s unique identification, making it a key requirement for Uganda Revenue Authority (URA) registration.

When clearing customs, the URA requires the original Export Certificate to cross-check important details, such as the chassis number, against your other import documents. This verification step is especially important for determining the vehicle’s age, which influences the calculation of Uganda’s Environmental Levy. Sometimes referred to as the Certificate of Cancellation, this document includes key information such as the chassis number and the year of manufacture. If the certificate is in a foreign language, like Japanese, you’ll need to provide a certified English translation along with the original. Keep in mind that photocopies or scanned versions are not accepted – they can cause delays and lead to extra storage fees at the port.

To avoid issues, double-check that the chassis number on the Export Certificate matches the numbers on your Bill of Lading and Commercial Invoice. Even a small mismatch can lead to URA rejecting your application.

It’s also a good idea to work with a licensed clearing agent who can upload a digital copy of the certificate to the URA system while you retain the original for physical verification. Having this document ready before your vehicle arrives at the port can save you from unnecessary delays and extra fees. This simple preparation step ensures a smoother customs clearance process.

4. Pre-Export Inspection Certificate

The Pre-Export Inspection Certificate, also known as the Certificate of Road Worthiness (CRW), is a mandatory document that ensures your vehicle complies with Uganda’s safety and quality standards before it is exported. This certificate is a key requirement under the Pre-Export Verification of Conformity (PVoC) program, overseen by the Uganda National Bureau of Standards (UNBS). Without this certificate, your vehicle will not clear customs upon arrival at the Ugandan border.

"The Regulation requires UNBS to carry out conformity assessment of all goods covered by compulsory standards… an exporter/importer of a used Motor Vehicle into Uganda shall ensure that it is subjected to Pre Export Verification of Conformity (PVoC) to ensure conformity to the prescribed Uganda Standard." – Dr. Ben Manyindo, Executive Director, Uganda National Bureau of Standards

The inspection process confirms the vehicle meets Uganda’s US845 standards for roadworthiness and adheres to Euro 4 emissions standards. Inspections are conducted by authorized agencies appointed by UNBS, such as HQTS, Intertek, EAA Service, QISJ, and the Japan Export Vehicle Inspection Center (JEVIC). These agencies evaluate the vehicle’s safety features, check compliance with age limits, and verify document accuracy.

Failing to secure a valid CRW comes with steep penalties. Non-compliance results in a 15% surcharge on the CIF value and 0.50% of the FOB value, with a minimum charge of $235 and a maximum of $3,000. Vehicles that fail to meet standards may even face destruction or be sent back to their origin.

To arrange a pre-export inspection, register at http://eportal.unbs.go.ug/. Inspection fees vary depending on the country of export: $140 for Japan, $200 for Singapore or the UK, $220 for South Africa, and $125 for the UAE. Make sure to use a UNBS-approved agency and obtain the original certificate. Customs will require the CRW along with your Bill of Lading and Commercial Invoice. With this certificate in hand, you’ll be well on your way to completing your vehicle’s registration process.

5. Certificate of Conformity

The Certificate of Conformity (CoC) is essential for proving that the vehicle you’re importing meets Uganda’s roadworthiness and safety standards. This document confirms compliance with Euro 4 emissions standards – set to take effect in Uganda by 2025 – and ensures the vehicle adheres to the national age limit, which prohibits imports older than 15 years. Without this certificate, your vehicle cannot be registered, no matter how complete your documentation is. Here’s how the CoC is issued and what it covers.

After a successful pre-export inspection, authorized organizations like the Japan Export Vehicle Inspection Center (JEVIC) or Quality Inspection Services Japan (QISJ) issue the CoC. These agencies assess whether the vehicle is suitable for use. For diesel vehicles, the inspection also verifies compliance with cleaner fuel standards.

The cost of obtaining a JEVIC certificate typically falls between $150 and $250. While this fee might seem steep, it helps avoid costly delays at the border. Additionally, vehicles older than 9 years are subject to environmental levies, which can be as high as 50% of the vehicle’s value, depending on its age.

Before shipping your vehicle, double-check that the chassis number matches across all inspection documents. This simple step can save you from lengthy delays or even outright rejection at the border. Vehicles manufactured after 2016 are prioritized for emissions compliance, making newer models easier to import with fewer regulatory obstacles.

These requirements, overseen by the Ministry of Works and Transport, aim to protect consumers and prevent the import of sub-standard vehicles. To complete the first-time registration process, you’ll need to present the Certificate of Conformity along with a Verification Account from an Inland Container Depot (ICD) or a border post. These documents are crucial for finalizing registration.

sbb-itb-7bab64a

6. Import Declaration Form

The Import Declaration Form is essential for documenting your vehicle’s entry into Uganda and establishing its legal ownership within the Uganda Revenue Authority (URA) system. Without this form, customs cannot release your vehicle, and registration becomes impossible.

A licensed clearing agent handles the filing of this declaration and processes the required transit documents (C63 or T1) on your behalf. The agent submits the form electronically through the URA customs system, ensuring all import duties and taxes are calculated and paid before the vehicle is released. Keep in mind, the registration book and number plates will only be issued once all taxes are fully cleared.

Before your clearing agent can proceed, you’ll need to obtain a Tax Identification Number (TIN) from the URA. To do this, visit the URA portal at ura.go.ug, download the TIN Excel template, fill it out, and upload it back to the portal. The TIN is mandatory for all customs transactions and links you permanently to the vehicle in the URA system. This step ensures smooth tracking and final clearance.

Once the declaration is filed, you can monitor your application status through the URA Motor Vehicle section. After paying all required duties – registration fees for a standard sedan, for example, amount to 1,218,000 UGX – you’ll receive a Verification Account from the Inland Container Depot (ICD) or border post. This, along with your Certificate of Conformity, is necessary to complete the first-time registration process.

Beyond tax collection, the Import Declaration Form serves as a critical legal document. It creates a permanent ownership record, which can be used as collateral for bank loans and simplifies future ownership transfers. By completing this process, you secure your investment and establish your legal claim to the vehicle.

Other Registration Requirements

Once you’ve gathered the six key documents, there are a few more steps to complete your vehicle registration. These additional requirements help the Uganda Revenue Authority (URA) verify your identity, manage tax-related matters, and issue your number plates without unnecessary delays.

You’ll need to provide valid identification. For Ugandans, this means a National ID. Non-citizens should present a Passport and Work Permit, while refugees need a Refugee ID. Diplomats must provide a Diplomatic ID along with a letter from the Ministry. If you’re a sole proprietor, you’ll also need to include your Business Name Registration Certificate. These documents help ensure that the URA can confirm your identity and vehicle details efficiently.

A vehicle verification report is another crucial step. This report confirms that your car’s details match the URA database. You can get it through the "Search and Certify Motor Vehicle Details" service on the URA portal for a fee of UGX60,000. Typically, the URA updates applicants on their verification status within two working days. This step ensures that your vehicle’s information is accurately entered into the URA system.

When it’s time to book your digital plates, you can track the process through the URA’s "Motor Vehicle" e-services. Standard registration fees are UGX1,218,000 for sedans, saloons, or estate cars, while personalized plates cost UGX20,000,000.

For companies, the process requires a Certificate of Incorporation and Company Form 20 instead of personal identification documents. Additionally, all applications must undergo verification by URA staff, and your Tax Identification Number (TIN) must be activated.

Common Mistakes and How to Avoid Them

Even small errors in documentation can slow down your registration process. Here’s a breakdown of common pitfalls and how to steer clear of them.

Payment registration errors are a frequent cause of delays. Mistakes like entering the wrong Tax Identification Number (TIN), selecting the wrong tax head (e.g., choosing excise duty instead of stamp duty), or inputting the incorrect payment amount can lead to lengthy refund processes. To avoid this, take your time to carefully review all payment details before submission.

Submitting non-original documents is another major issue. Applications often get delayed because essential documents – like the original supplier invoice, Bill of Lading, or the Registration Book (or Cancellation Certificate) from the country of origin – are missing or not in their original form. The URA requires these originals for processing, and any non-English documents must include certified translations to avoid verification issues. Skipping this step can hold up the entire process.

Timing mistakes can derail your registration entirely. All registration steps must be completed while the vehicle is still in the bonded warehouse. If you wait until the vehicle leaves, you could face legal complications. Additionally, attempting to register vehicles older than the 15-year import age limit will result in automatic rejection, as this rule is strictly enforced. Staying on top of deadlines is essential to avoid these setbacks.

Since hiring a clearing agent is mandatory for first-time registration, selecting a qualified and reliable agent is key. A good clearing agent will handle transit documents like the C63 and T1 forms correctly and ensure your vehicle meets Euro 4 emissions standards through pre-export inspections by accredited organizations such as the Japan Export Vehicle Inspection Center (JEVIC).

Take advantage of the URA’s online tools, like "Document Authentication" and "View Vehicle Search Report", to verify your documents before submitting them. The "Document Authentication" tool ensures your forms and certificates are valid, while the "View Vehicle Search Report" lets you cross-check your vehicle details with official records. Using these tools can help you catch and correct errors before they cause delays in your application.

Conclusion

Getting your car registered in Uganda starts with having all the right paperwork in order. The process requires six essential documents to confirm ownership, meet regulations, and calculate taxes accurately. Missing even one piece of documentation can bring everything to a standstill.

Having everything in place not only ensures legal ownership but also protects your financial interests. Proper registration allows you to use your vehicle as collateral for loans and makes selling it later much easier. Double-check your paperwork to avoid delays, costly storage fees, or extra port charges.

You’ll also need a valid TIN and a qualified clearing agent – both are non-negotiable. Don’t forget to confirm that your car complies with Uganda’s import rules, like the 15-year age limit and Euro 4 emissions standards. Accredited inspectors, such as the Japan Export Vehicle Inspection Center (JEVIC), can help with this verification. Taking care of these details beforehand will save you time, money, and unnecessary stress during the registration process.

FAQs

What should I do if my car’s documents have mismatched chassis numbers?

If the chassis or VIN numbers on your car’s documents don’t match, it can cause delays in the registration process and might even stop you from getting license plates. To fix this, you’ll need to confirm the correct numbers and coordinate with the appropriate authorities to update or correct the records.

This might mean getting a revised title or other official paperwork from your local DMV or similar agency. Taking care of this issue quickly is crucial to avoid any hassles with your car’s registration.

What steps should I take to ensure my car meets Uganda’s safety and emissions requirements?

To comply with Uganda’s safety and emissions regulations, your car must undergo an official motor vehicle inspection, as mandated by the Traffic and Road Safety (Motor Vehicle Inspection) Regulations of 2016. This inspection focuses on essential systems like brakes, lights, and exhaust emissions to ensure your vehicle is both safe to drive and meets environmental standards.

Once your car passes the inspection, you’ll be issued a Certificate of Fitness. This certificate is essential for legally registering and operating your vehicle in Uganda. Routine maintenance and keeping your paperwork current will help you avoid any compliance issues with these requirements.

Why do you need a licensed clearing agent to register a car in Uganda?

A licensed clearing agent plays an important role in the car registration process in Uganda, ensuring that all necessary paperwork is submitted accurately and that legal procedures are properly followed. They take care of key tasks such as providing proof of ownership, handling importation documents, and ensuring registration fees are paid – steps that are essential to meet Ugandan regulations.

These agents are particularly valuable when navigating the often-complicated import documentation, including bills of lading, customs clearance forms, and import certificates. Their knowledge helps avoid unnecessary delays and ensures the process runs efficiently and in compliance with the law. This can be especially helpful for first-time car owners or importers who may not be familiar with the registration requirements.

Related Blog Posts

- How To Transfer Car Ownership In Uganda

- How to register a used car in Uganda

- Car import duties in Uganda: URA fees, taxes and clearance process

- How to import a car into Uganda: Step-by-step guide for 2025