In Uganda, having car insurance isn’t just a good idea – it’s required by law. The Motor Vehicle Insurance (Third Party Risks) Act of 1989 mandates that every vehicle (except government-owned ones) must have at least third-party insurance. Without it, you risk fines, imprisonment, and suspension of your driving permit. But beyond legality, insurance protects you financially from accidents, theft, or fire damage.

Here’s what you need to know:

- Types of Car Insurance in Uganda:

- Third-Party Only (TPO): Covers injuries or damage caused to others. It’s the minimum legal requirement.

- Third-Party Fire & Theft (TPFT): Adds protection for fire damage and theft of your vehicle.

- Comprehensive Insurance: Covers third-party liabilities, fire, theft, and damage to your own vehicle.

- Choosing the Right Insurer:

- Ensure the company is licensed by the Insurance Regulatory Authority (IRA).

- Look for quick claim processing (typically 5-7 days) and strong customer support.

- Check for add-ons like roadside assistance or towing services.

- Saving on Premiums:

- Maintain a clean driving record.

- Install anti-theft devices.

- Pay annually instead of monthly.

- Choose vehicles with easily available spare parts.

Getting the best deal means balancing cost with coverage. Start by comparing quotes, understanding policy exclusions, and selecting coverage that fits your needs and budget.

Car Insurance Coverage Options Explained

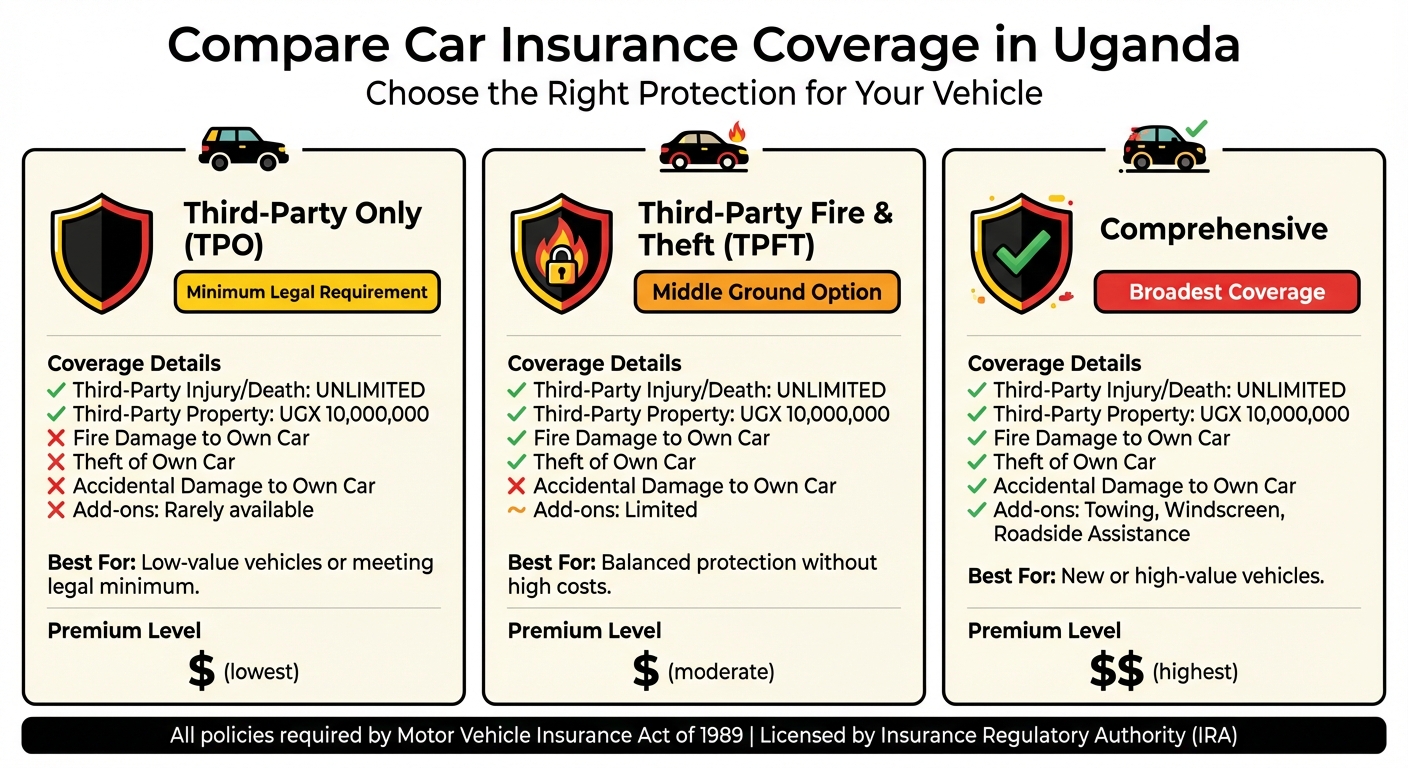

Uganda Car Insurance Coverage Comparison: TPO vs TPFT vs Comprehensive

Explore Uganda’s three primary car insurance types to find the best fit for your vehicle’s value and budget. Below is a breakdown of each option to help you compare quickly.

Third-Party Insurance

Third-Party Only (TPO) is the minimum legal requirement for all non-government vehicles in Uganda. This policy covers liabilities for injuries, deaths, or property damage caused to others, but it does not include protection for your own vehicle. Coverage for third-party injuries and deaths is unlimited, while property damage is capped at UGX 10,000,000.

"The person who benefits from Motor Third Party is a third party who suffers loss or death or bodily injury as a result of an accident. This maybe any road user, such as a pedestrian, a motor vehicle passenger, a property owner involved in an accident." – Insurance Regulatory Authority (IRA)

This option is ideal for low-value vehicles or those seeking to meet the legal minimum without additional costs.

Third-Party Fire and Theft Insurance

Third-Party Fire and Theft (TPFT) builds on the coverage provided by TPO. In addition to third-party liability, it protects your own vehicle in cases of fire damage or theft. However, it does not cover repairs to your car if it is damaged in an accident. TPFT is a middle-ground option, offering more security than TPO without the higher cost of comprehensive insurance.

Comprehensive Insurance

Comprehensive Insurance offers the broadest coverage available in Uganda. It includes everything covered under TPO and TPFT, while also protecting your own vehicle against accidental damage. This policy addresses damages from accidents, fire, theft, and other specified risks. Optional add-ons, such as roadside assistance, towing, wreckage removal, and windscreen repair, provide even more flexibility. Comprehensive insurance is best suited for new or high-value vehicles where repair or replacement costs are substantial. However, standard policies typically exclude wear and tear, mechanical breakdowns, or accidents caused by driving under the influence of alcohol.

| Feature | Third-Party Only (TPO) | Third-Party Fire & Theft (TPFT) | Comprehensive |

|---|---|---|---|

| Legal Requirement | Minimum legal requirement | Exceeds legal minimum | Exceeds legal minimum |

| Third-Party Injury/Death | Covered (Unlimited) | Covered (Unlimited) | Covered (Unlimited) |

| Third-Party Property | Covered (UGX 10,000,000) | Covered (UGX 10,000,000) | Covered (UGX 10,000,000) |

| Fire Damage to Own Car | Not Covered | Covered | Covered |

| Theft of Own Car | Not Covered | Covered | Covered |

| Accidental Damage to Own Car | Not Covered | Not Covered | Covered |

| Add-ons | Rarely available | Limited | Yes (Towing, Windscreen, etc.) |

The right choice depends on your vehicle’s value, your budget, and the risks you face on the road. TPO ensures you meet legal requirements and protects others, TPFT adds coverage for fire and theft, and comprehensive insurance provides extensive protection for your own car.

Comparing Car Insurance Providers in Uganda

What to Look for When Choosing an Insurer

When selecting a car insurance provider in Uganda, start by ensuring the company is licensed by the Insurance Regulatory Authority (IRA). This licensing confirms the insurer complies with regulatory standards and offers you legal protection.

Another key consideration is how quickly the insurer processes claims. Reliable companies in Uganda generally settle claims within 5 to 7 working days. Some providers even leverage technology to speed things up. Be sure to confirm the expected claim settlement timeline and whether claims are managed in-house before committing to a policy.

Customer support is equally important. Look for insurers that provide 24/7 digital support, quick online quotes, and useful extras like roadside assistance. For example, APA Insurance offers the "Vvuga Motor Cover", which allows you to buy and manage policies entirely online, including filing claims. Similarly, Turaco enables claims reporting through WhatsApp. The best insurers offer multiple support channels – online, phone, and in-person – to ensure you’re covered whenever you need help.

Don’t overlook add-ons that go beyond basic coverage. These extras, such as roadside assistance, towing services, medical cover, and windscreen protection, can add real convenience and value to your policy. However, it’s critical to review policy exclusions carefully. Common exclusions include wear and tear, mechanical failures, and accidents involving driving under the influence. Knowing these details upfront will save you from surprises when filing a claim. If you feel a claim has been unfairly denied, you can escalate the issue to the IRA’s Complaints Bureau via email ([email protected]) or their toll-free line.

Lastly, consider the insurer’s financial strength. A company with a strong credit rating, like Goldstar Insurance with its AA rating, is often better equipped to handle large claims without delays.

These factors lay the groundwork for evaluating Uganda’s top car insurance providers, as detailed below.

Comparison of Major Insurers in Uganda

Uganda’s insurance market is home to several well-established providers, each offering unique strengths. UAP General leads the pack, reporting a 2022 turnover of UGX 217.7 billion, and is well-regarded for its extensive branch network. Sanlam General comes in second with UGX 100.4 billion in turnover, followed by Jubilee Insurance at UGX 92.7 billion. Jubilee also has a strong presence across East Africa, making it a popular choice for regional coverage.

Britam Uganda, with a turnover of UGX 73.2 billion, stands out for its accolades, including being named "Top Employer Africa 2026" for two consecutive years and receiving recognition for innovation at the Uganda Insurance Innovation Awards in March 2023. APA Insurance, ranked 13th with UGX 24.8 billion in turnover, focuses on customer service and offers robust online platforms for policy management and claims.

Here’s a quick comparison of some of Uganda’s top insurers:

| Provider | 2022 Turnover (UGX) | Key Strength | Notable Features |

|---|---|---|---|

| UAP General | 217.7 billion | Market leader | Extensive branch network |

| Sanlam General | 100.4 billion | High growth | Comprehensive non-life products |

| Jubilee Insurance | 92.7 billion | Established reputation | Regional presence across East Africa |

| Britam Uganda | 73.2 billion | Recognized for excellence | Top Employer Africa 2026; Most innovative (2023) |

| Goldstar Insurance | 32.2 billion | Strong financial stability | AA credit rating |

| APA Insurance | 24.8 billion | Customer service focus | Online claim reporting and assistance |

| Turaco | – | Microinsurance focus | 4-hour claim turnaround; WhatsApp-based service |

When comparing these providers, don’t just focus on premium costs. A company with a strong claims settlement record, accessible emergency services, and clear policy terms often delivers far more value than the cheapest option. As Alhaj Kaddunabbi Ibrahim Lubega, CEO of the Insurance Regulatory Authority of Uganda, wisely puts it:

"The best thing you can do for anyone interested in buying an insurance policy is to help them understand how a given policy operates. This will help the person in making the right decision, well knowing what is contained in the policy."

How to Get and Compare Insurance Quotes

Getting Quotes Online

One of the easiest ways to get multiple insurance quotes is by using online platforms like AutoMag.ug. These platforms save you the hassle of reaching out to each insurer individually. Before diving in, make sure the platform or provider is licensed by the Insurance Regulatory Authority (IRA). You’ll need your vehicle logbook handy, and if it’s a used car, an engineer’s report is usually required. As of January 2, 2026, the IRA has authorized 144 industry players to operate, including 19 non-life insurance companies. Alternatively, you can approach insurers directly, though most will ask you to fill out and sign a proposal form to provide a quote.

Once you’ve gathered quotes, it’s time to assess them. This process involves matching the details of the quotes with your vehicle’s specifics and your driving history, building on the earlier discussion about coverage types and insurer performance.

Evaluating Quotes Based on Your Vehicle and Driving History

When reviewing quotes, don’t just focus on the price tag. Premiums vary depending on factors like your car’s age and value – newer or high-value cars typically cost more to insure. Your driving record also plays a big role; clean records often lead to lower premiums. How you use your car matters too – commercial vehicles usually come with higher rates compared to those used for personal purposes. For example, insuring popular models like used Toyotas might be more affordable because spare parts are easier to find and less costly. Be honest about your driving history, as inaccurate details could lead to premium adjustments later.

When comparing quotes, dig deeper into the policy details. Lower premiums might seem appealing, but they often come with fewer protections or higher out-of-pocket costs. Pay attention to the deductible – the amount you’ll pay before your insurance kicks in. Opting for a higher deductible can reduce your annual premium but means you’ll need to pay more upfront if you file a claim. Keep an eye out for added perks like roadside assistance, towing services, or medical coverage. These extras can make slightly higher premiums worth considering.

sbb-itb-7bab64a

Ways to Save Money on Car Insurance

How to Qualify for Discounts

Maintaining a clean driving record can significantly reduce your car insurance premiums. Insurers often reward drivers who avoid filing claims with lower renewal rates. Another way to save is by installing anti-theft devices, such as GPS trackers or car alarms. Many insurers in Uganda offer discounted premiums for vehicles with enhanced security features. Additionally, bundling multiple insurance policies or opting for a higher deductible can help cut down on annual insurance costs.

Money-Saving Tips for Ugandan Drivers

There are other practical steps you can take to save on car insurance. Paying your premium in one annual payment instead of monthly or shorter installments can lead to noticeable savings. In Uganda, short-term policies tend to be disproportionately expensive. For instance, a 20-day policy might cost around 15% of the annual rate, and a six-month policy could cost up to 70% of the yearly premium. Another cost-saving tip is to choose a vehicle model with spare parts that are easy to find locally, as this often lowers insurance expenses. Lastly, if your vehicle’s usage changes – say, from commercial to private – inform your insurer right away to adjust your rate accordingly.

Conclusion

Getting the best car insurance in Uganda takes some effort, but it’s worth it. Start by choosing the right type of coverage – whether it’s Motor Third Party, Third-Party Fire and Theft, or Comprehensive insurance – based on your budget and how much your vehicle is worth. The right coverage should fit your specific needs and provide peace of mind.

Once you’ve decided on coverage, make sure the insurer is properly licensed by the Insurance Regulatory Authority (IRA) of Uganda. This step is essential to ensure financial protection and gives you the option to seek help from the IRA’s Complaints Bureau if you ever run into problems.

Before signing anything, take the time to carefully review the policy exclusions and coverage limits. Each insurer sets their own limits, and understanding these details upfront can save you from unpleasant surprises during a claim.

To keep your premiums as low as possible, consider a few cost-saving measures. Installing anti-theft devices like GPS trackers, maintaining a spotless driving record, and opting for a higher deductible can all help reduce your insurance costs. Paying your premium annually instead of monthly can also save you money. And don’t forget – if your vehicle’s use changes, such as switching from commercial to private use, notify your insurer right away to avoid complications down the road.

FAQs

What should I consider when choosing car insurance in Uganda?

When choosing car insurance in Uganda, it’s essential to ensure the policy satisfies the legal requirement for Motor Third-Party Insurance. This type of coverage is mandatory and protects against liability for injury or damage caused to others. Beyond this, you’ll need to decide what level of protection suits your needs: Third-Party Only (TPO) for basic liability coverage, Third-Party Fire & Theft (TPFT) for additional protection against fire and theft, or Comprehensive Insurance, which also includes coverage for damage to your own vehicle.

Your premium will be influenced by several factors, including the age, engine size, and value of your car, as well as your driving record and whether the vehicle is for personal or commercial use. Some insurers may offer discounts for features like anti-theft devices or if you bundle multiple policies together, so it’s worth exploring these options.

Take the time to thoroughly review the policy details. Pay close attention to exclusions, the claims process, and renewal terms. It’s also wise to select an insurer known for efficient claims handling and excellent customer service – this can make all the difference when you need support. A reliable policy ensures you’re covered and confident every time you hit the road.

What are the best ways to lower my car insurance costs in Uganda?

Lowering car insurance costs in Uganda doesn’t have to be complicated. Start by selecting coverage that matches your needs. For older cars, Third-Party Only or Third-Party Fire & Theft policies are often more budget-friendly alternatives to comprehensive coverage, while still meeting legal requirements.

You can also save by shopping around. Compare quotes from multiple insurers to find the best deal. Adding anti-theft measures, like alarms or GPS trackers, can help too – many insurers offer discounts for enhanced vehicle security. Another tip? Bundle your car insurance with other policies, such as home insurance, to unlock additional savings.

Adjusting your deductible is another way to cut costs. Opting for a higher deductible lowers your premium, though you’ll need to cover more out of pocket if you file a claim.

Your driving habits also play a role. A clean driving record can earn you lower rates and no-claims discounts. And finally, keep your policy details current. If your vehicle usage drops or you’ve added new safety features, let your insurer know – you could avoid paying for coverage you no longer need.

What’s the difference between Third-Party, Third-Party Fire & Theft, and Comprehensive car insurance?

Third-Party insurance is the most basic level of coverage. It takes care of your legal responsibility if you cause injuries, fatalities, or property damage to others on the road. However, it doesn’t provide any protection for your own vehicle.

Third-Party Fire & Theft builds on this by including coverage for damage or loss to your car caused by fire or theft. That said, it still won’t cover repairs to your vehicle if it’s damaged in a collision.

Comprehensive insurance provides the most extensive coverage. It includes everything from Third-Party Fire & Theft and adds protection for your car in case of accidents, fire, or theft. Essentially, it covers both damage to others and your own vehicle, offering peace of mind in a variety of situations.

Related Blog Posts

- Car insurance prices in Uganda

- Comprehensive car insurance in Uganda: What to know in 2025

- What is the cost of comprehensive car insurance in Uganda?

- Car Insurance Uganda 2026: How Much It Costs